Stricter Measures by Skatteverket: What Foreign-Owned Companies in Sweden Need to Know

At 1Office, we’ve observed noteworthy changes in Skatteverket, Sweden’s Tax Agency, practices, particularly affecting businesses with international directors or owners. These updates are essential for maintaining compliance and protecting your company’s operations in Sweden.

Key Changes in Skatteverket’s Policies

1. New Documentation Requirements

Skatteverket now routinely requests detailed company information, especially for foreign-owned companies in Sweden:

- Proof of no tax debts – Tax Debt Clearance Certificates:

- Non-resident board members must provide a tax clearance certificate from their home country (typically for the past 2 years).

- These certificates must be recent and issued by the relevant tax authority.

- Ownership structure details (ägandekedja):

- Skatteverket demands complete transparency of ownership, including share percentages and dates.

Example: A Bulgarian director of a Swedish company needed to submit tax compliance proof from Bulgarian authorities to maintain the company’s F-tax registration.

2. Accelerated Bankruptcy Processes for Tax Debts in Sweden

Skatteverket has implemented faster timelines for initiating bankruptcy proceedings in cases of unpaid tax debts:

- Standard Bankruptcy Process

- Asset Investigation: Conducted over 30 days by the Enforcement Authority (Kronofogden).

- Court Hearing: Scheduled within 20–30 days of the petition.

- Applies when: The company engages with Skatteverket or Kronofogden.

- Accelerated Process:

- No Asset Investigation: Skipped due to unresponsive companies or those with prior enforcement histories.

- Court Hearing: Set in just 14 days.

- Trigger: Simplified bankruptcy procedure (Förenklat konkursförfarande) for cases with clear violations.

These rapid measures highlight the importance of addressing tax arrears quickly to avoid complications.

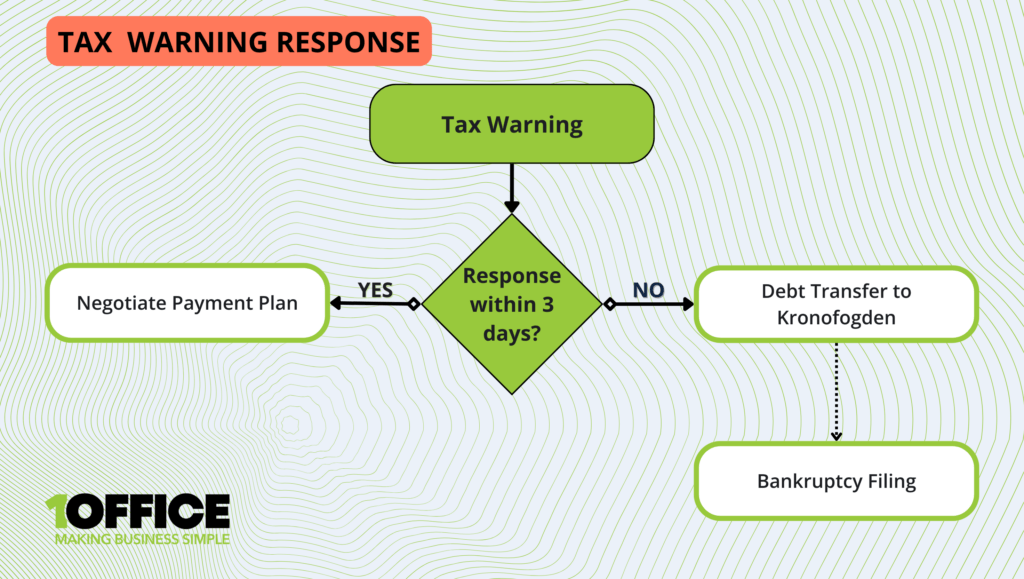

Figure 1: How to respond to a Swedish tax warning—act fast to avoid debt transfer or liquidation. Source: 1Office.

NB! Even debts as low as SEK 400,000 can trigger these swift actions, so prompt attention to tax arrears is critical.

3. Strict Deadlines & No Extensions

Skatteverket continues to enforce tight deadlines for responding to document requests, particularly for F-tax approvals:

- Common response periods include just 72 hours.

- Missing deadlines or failing to engage with authorities may result in F-tax revocation, asset investigations, or liquidation.

Strategic Recommendations for Foreign-Owned Businesses in Sweden

Navigating Skatteverket’s evolving regulations can be challenging, especially for businesses with international ownership or directorship. By implementing proactive measures, companies can ensure compliance and minimize risks. Below are 1Office’s top recommendations:

1. Conduct a “Skatteverket Stress Test”

- Audit your ownership structure (ägandestruktur): Ensure it adheres to the latest disclosure requirements, including ownership transparency and documentation of share percentages.

- Identify non-resident directors and verify if they require tax clearance certificates from their home countries.

2. Implement Early Warning Systems

- Monitor your company’s skattekonto status (tax account status) on a weekly basis to detect potential tax issues early.

- Set up alerts for any correspondence from Skatteverket or the Enforcement Authority (Kronofogden).

3. Designate a Swedish-speaking Compliance Officer

- Appoint someone fluent in Swedish to handle communications with Skatteverket and other authorities.

- This ensures timely responses and reduces the risk of misinterpretations that could lead to non-compliance.

- Pro Tip: 1Office can help!

1Office Advisory Protocol: Proven Strategies for Compliance

- Follow the 48-Hour Response Rule:

- Acknowledge all letters or correspondence from Skatteverket or Kronofogden within 2 business days. Prompt responses can buy critical time for resolving potential issues.

- Prepare an “Asset Map”:

- Maintain an updated list of company assets. This can prevent accelerated enforcement actions.

- Monitor Deadlines Closely:

- Ensure timely submission of all required documentation, including tax clearance certificates, to avoid penalties or escalated processes.

Proactively applying these strategies will help foreign-owned companies navigate Sweden’s regulatory landscape with greater confidence. If you need personalized support, 1Office’s experienced team is ready to assist you at every step.

“Proactive compliance is key to ensuring smooth operations for foreign-owned companies in Sweden.” – 1Office

Partner with 1Office for Seamless Compliance

Skatteverket’s stricter measures may seem challenging, but 1Office’s expertise ensures your company stays compliant. From F-tax registration to urgent negotiations, we provide tailored solutions for international entrepreneurs in Sweden.