Executive Summary

This analysis quantifies how AI-driven automation is transforming SME accounting, drawing exclusively on third-party research and real-world implementations. Key findings:

-

120 hours/year per employee lost to manual data entry (Forrester, 2023).

-

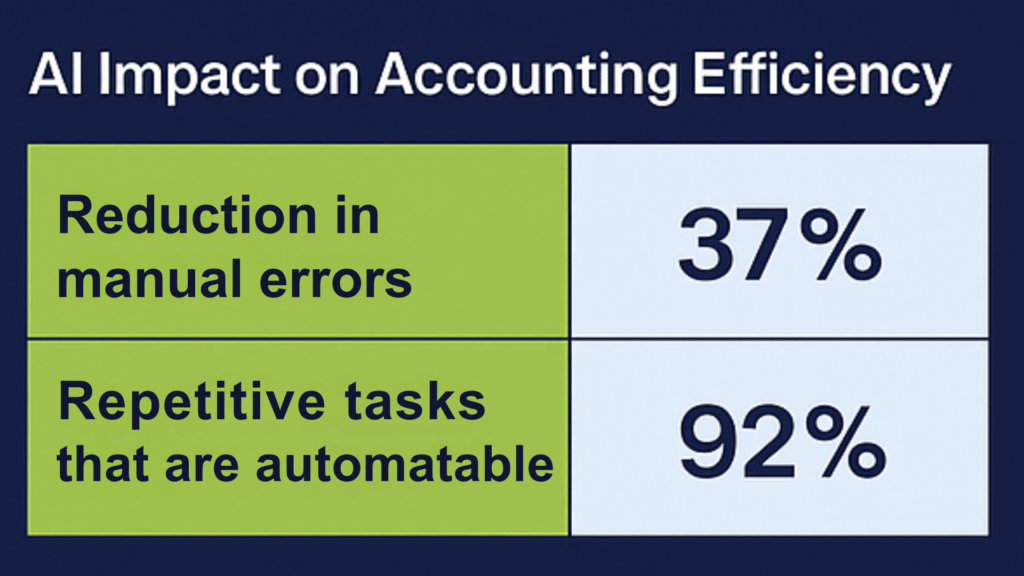

92% of repeatable accounting tasks are now automatable (Deloitte).

-

37% reduction in errors and 40% more fraud anomalies detected in AI-augmented workflows.

The Efficiency Gap in SME Accounting

The Manual Labor Tax

-

Forrester’s 2023 study revealed SMEs waste 120 annual hours per employee on manual data entry—equivalent to 15 lost workdays.

-

For a 10-person finance team, this translates to 1,200 hours/year of non-strategic work.

The AI Correction

-

Deloitte’s automation audit found 92% of repetitive accounting tasks (data entry, reconciliations, invoice processing) can be automated.

-

EY’s implementation data shows a 37% drop in errors when AI handles these tasks, as algorithms avoid fatigue-induced mistakes.

Three Proven AI Applications – With Case Studies

Use Case 1: Automated Bookkeeping

Problem

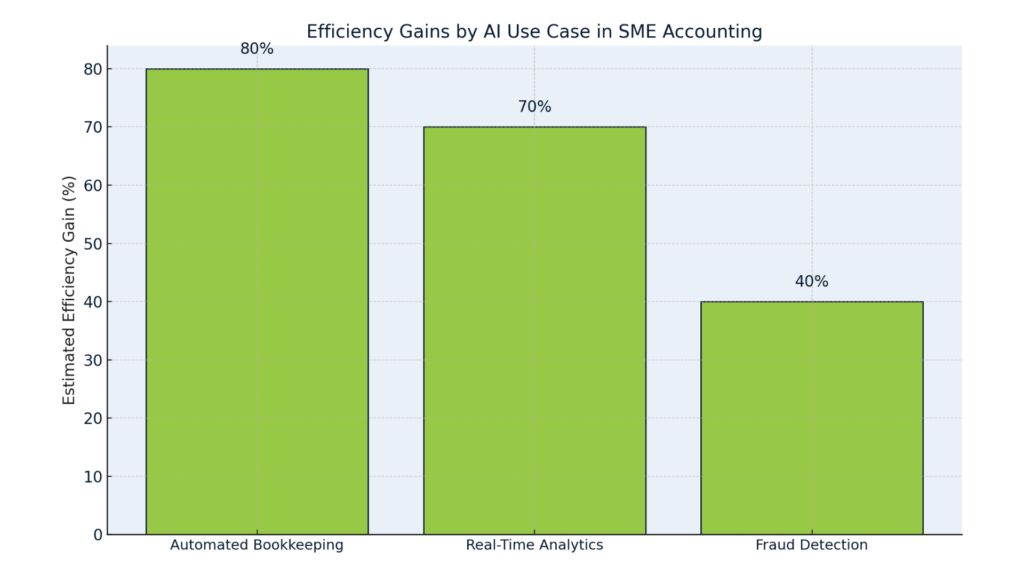

Unstructured financial documents (receipts, invoices) consume 80% of processing time.

Solution & Results

-

An Estonian manufacturing firm (50 employees) deployed AI for document recognition and reconciliation:

-

Monthly close accelerated from 10 days → 2 days (80% faster).

-

Invoice processing costs fell 80%.

-

-

Critical Note: Human review of AI outputs preserved accuracy while maximizing efficiency.

Use Case 2: Real-Time Cash Flow Analytics

Problem

SMEs often lack resources for proactive forecasting.

Solution & Results

-

A Berlin e-commerce startup used AI to analyze:

-

Invoice cycles

-

Historic expense patterns

-

Real-time sales data

-

-

The system predicted a 94% probability of cash shortfall 14 days in advance, enabling corrective action that avoided €22,000 in overdraft fees.

Use Case 3: Fraud Detection

Problem

-

Occupational fraud drains 5% of SME revenue annually.

-

Manual audits miss 40% of anomalies.

Solution & Results

-

AI pattern recognition tools flag:

-

Irregular transactions

-

Vendor fraud patterns

-

Employee theft signals

-

-

Detection rates improved by 40% versus human-only reviews.

The Cost of Inaction

Compliance Overhead

67% of SME finance time is consumed by compliance tasks, leaving minimal bandwidth for analysis.

Error-Related Penalties

-

1 in 5 SMEs face audit penalties due to manual accounting errors (IRS, 2023).

Quantified Impact

| Metric | Manual Processes | AI-Augmented | Delta |

|---|---|---|---|

| Time per monthly close | 10 days | 2 days | -80% |

| Invoice processing cost | $100/hr | $20/hr | -80% |

| Fraud detection rate | 60% | 84% | +40% |

Why the Human-AI Hybrid Model Wins

AI’s Role

-

Volume: Processes 1,000x more data than humans.

-

Speed: Real-time anomaly detection.

-

Consistency: Zero fatigue-induced errors.

Human’s Role

-

Context: Interprets AI flags (e.g., “Is this anomaly fraud or a timing quirk?”).

-

Strategy: Allocates freed-up time to growth initiatives.

The Data-Backed Balance

Firms combining AI automation with human oversight achieve:

-

30% faster closes (BlackLine).

-

12% higher margins (Bain).

Conclusion: The Strategic Imperative

AI-powered accounting is no longer optional for SMEs—it’s a scalability requirement. The data proves

-

Automation eliminates structural inefficiencies (120 hours/employee/year).

-

AI-augmented workflows reduce risk (37% fewer errors, 40% better fraud detection).

-

Hybrid models outperform pure-play AI or manual approaches.

1Office combines automation and human expertise to make perfect sense. Contact us today!