Introduction

Between 2025 and 2026, the global accounting profession is undergoing a seismic transformation. Catalyzed by rapid advances in AI, the expansion of ESG compliance, and regulatory convergence across Europe, accounting is no longer confined to balance sheets and ledger entries. For service providers like 1Office, which support thousands of location-independent companies, these shifts are not abstract, they are foundational.

This case study examines the forces driving change in the accounting sector. Supported by verified data, market projections, and regulatory updates, this blog provides a forward-looking lens on how firms and founders can prepare for the challenges and opportunities that lie ahead.

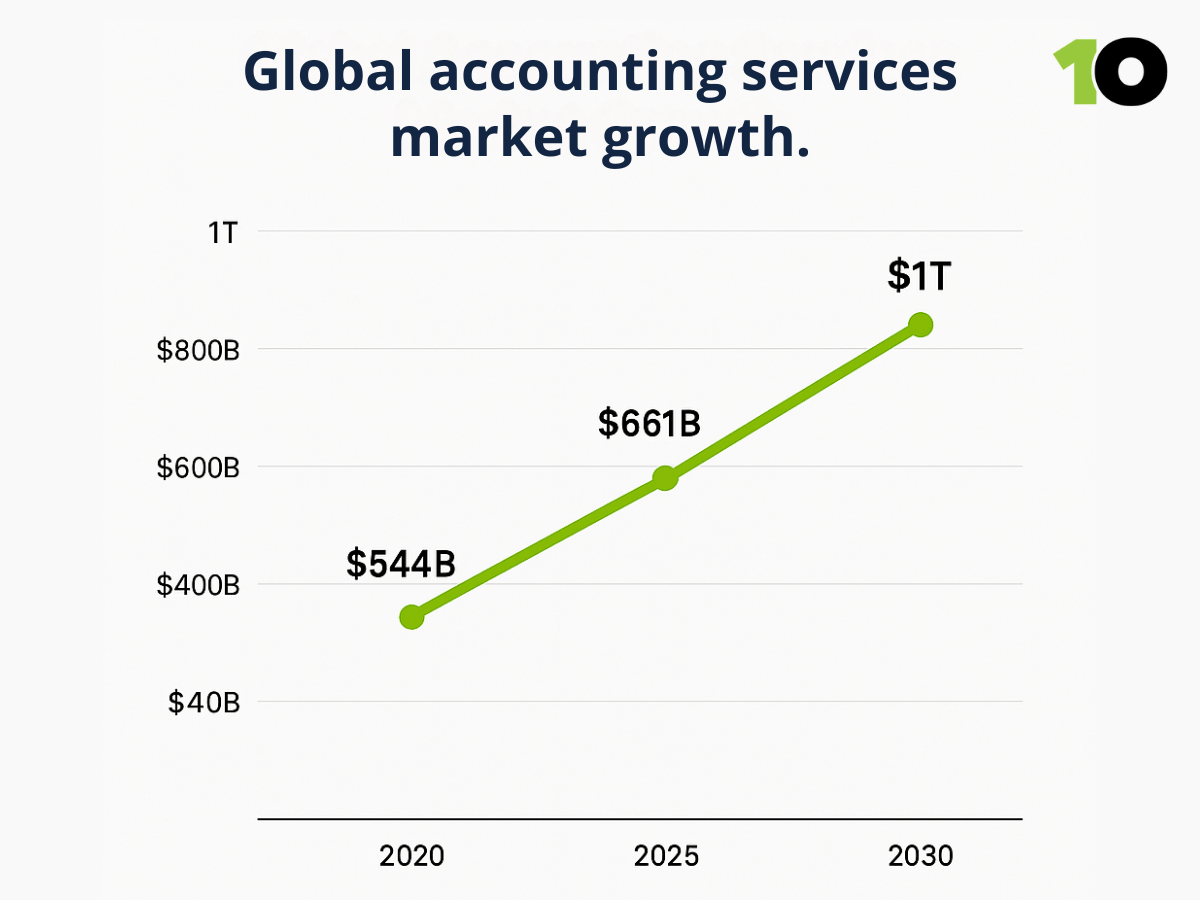

As the global accounting services market approaches US $661 billion in 2025, growing at a steady 3.9% CAGR over the past year, accountants and businesses alike are being reshaped by AI, automation, digitalization, and evolving regulation. Source: The Business Research Company .

The global accounting outlook: bigger and more digital

The global accounting services market is projected to reach $661 billion by the end of 2025, up from $544.1 billion in 2020. That growth will continue in 2026, with forecasts pointing toward a $1 trillion market by the end of the decade. However, the value is increasingly concentrated among firms investing in automation and advisory, while those relying on labor-intensive bookkeeping are seeing compressing margins.

In 2025, over 90% of accounting firms worldwide are expected to use cloud platforms for bookkeeping and financial reporting. Integration between compliance tasks, document management, and tax submissions is the new norm. This shift is especially relevant for 1Office’s remote-first clientele, who rely on real-time dashboards and cross-border support to stay compliant from anywhere.

AI and automation: the core disrupter

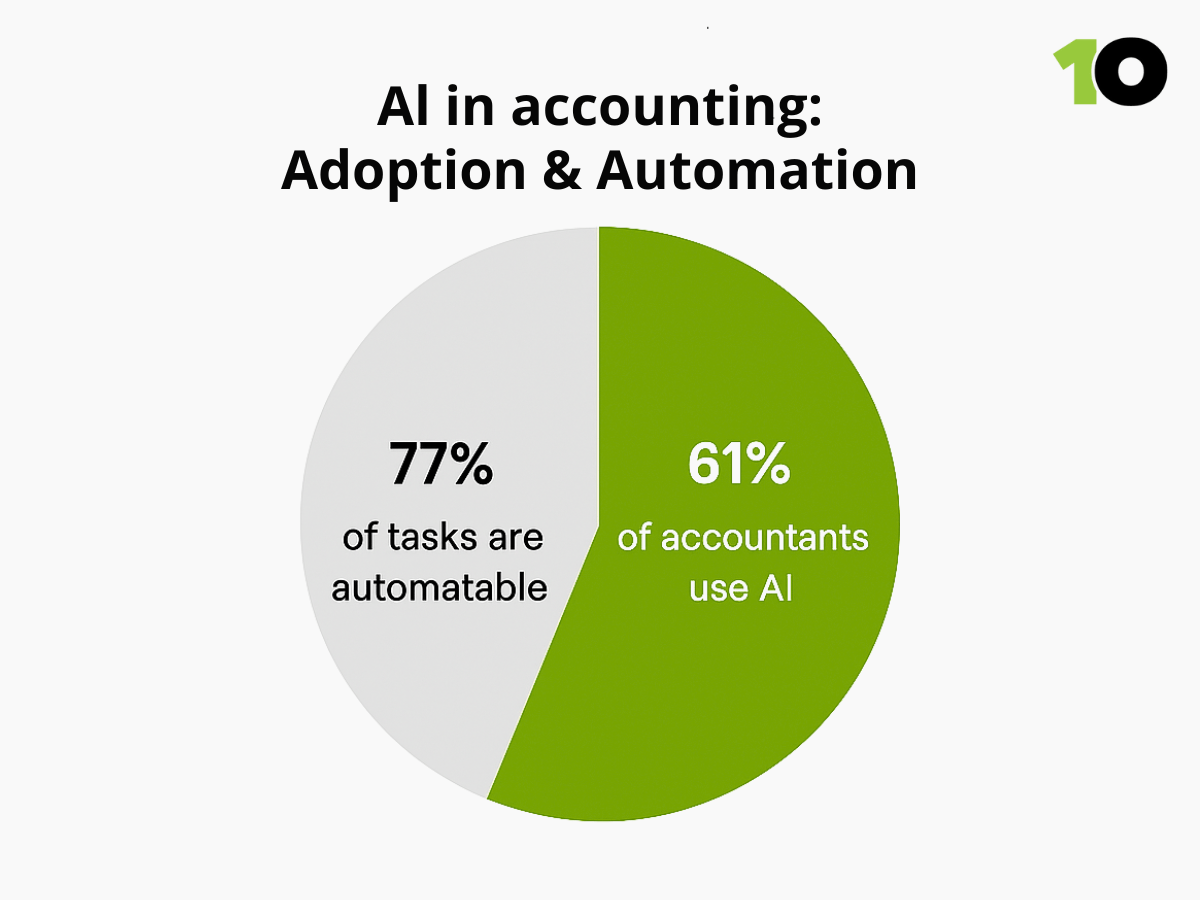

AI is quickly redefining how accounting services are delivered. By 2025, 61% of accountants are actively embracing AI as a strategic opportunity, and 77% of routine accounting tasks are considered automatable. The AI-driven accounting market is projected to grow from $6.7 billion in 2025 to $16 billion by 2028, representing a 45% compound annual growth rate. This shift is not theoretical, firms like EY have committed $1 billion to AI development, building “Agentic Platforms” that improve audit quality by up to 25%.

Instead of replacing professionals, AI is transforming their role: from data processors to strategic advisors. Accountants are now expected to interpret AI-generated insights, identify tax optimization opportunities, and support clients through financial decision-making.

Cybersecurity, blockchain, and reporting integrity

As digital records become the backbone of financial transparency, the security of accounting systems is under increased scrutiny. Firms are beginning to trial blockchain-based audit trails, universal-entry bookkeeping models, and zero-knowledge proofs to protect data while ensuring traceability. Looking ahead, quantum-proof encryption may enter the conversation, particularly for multinational audits.

Accounting trends in Europe: regulation and complexity rise

Europe’s accounting rules are tightening — and firms must now navigate a fast-changing matrix of regulation and reporting. Three major trends define the 2025–2026 landscape:

The first is the expanding influence of ESG regulation. With the Corporate Sustainability Reporting Directive (CSRD) entering full enforcement from 2025 to 2026, more than 50,000 companies operating in the EU are now required to disclose ESG metrics that align with European Sustainability Reporting Standards (ESRS). For accounting firms, this means integrating non-financial data into core reporting services and ensuring that it’s auditable.

Second, digital invoicing is rapidly expanding. France, Poland, and Italy have adopted mandatory B2B e-invoicing frameworks, and Germany, Spain, and Belgium are scheduled to follow by 2026. These systems require invoices to be submitted directly to tax authorities, accelerating demand for real-time, automation-ready accounting software.

Lastly, the EU’s “VAT in the Digital Age” (ViDA) initiative is moving toward unified, digital VAT reporting and real-time cross-border compliance. Businesses will face stricter documentation standards for intra-EU trade, making tax automation a necessity—especially for SMEs and digital entrepreneurs.

Companies like 1Office, operating across Estonia, Finland, Sweden, Lithuania, and the UK, are uniquely positioned to help clients navigate this patchwork of compliance frameworks. But the work is intensifying: staying ahead now requires synchronized systems, multilingual support, and regional expertise across multiple jurisdictions.

Outsourcing and third-party services as scalable infrastructure

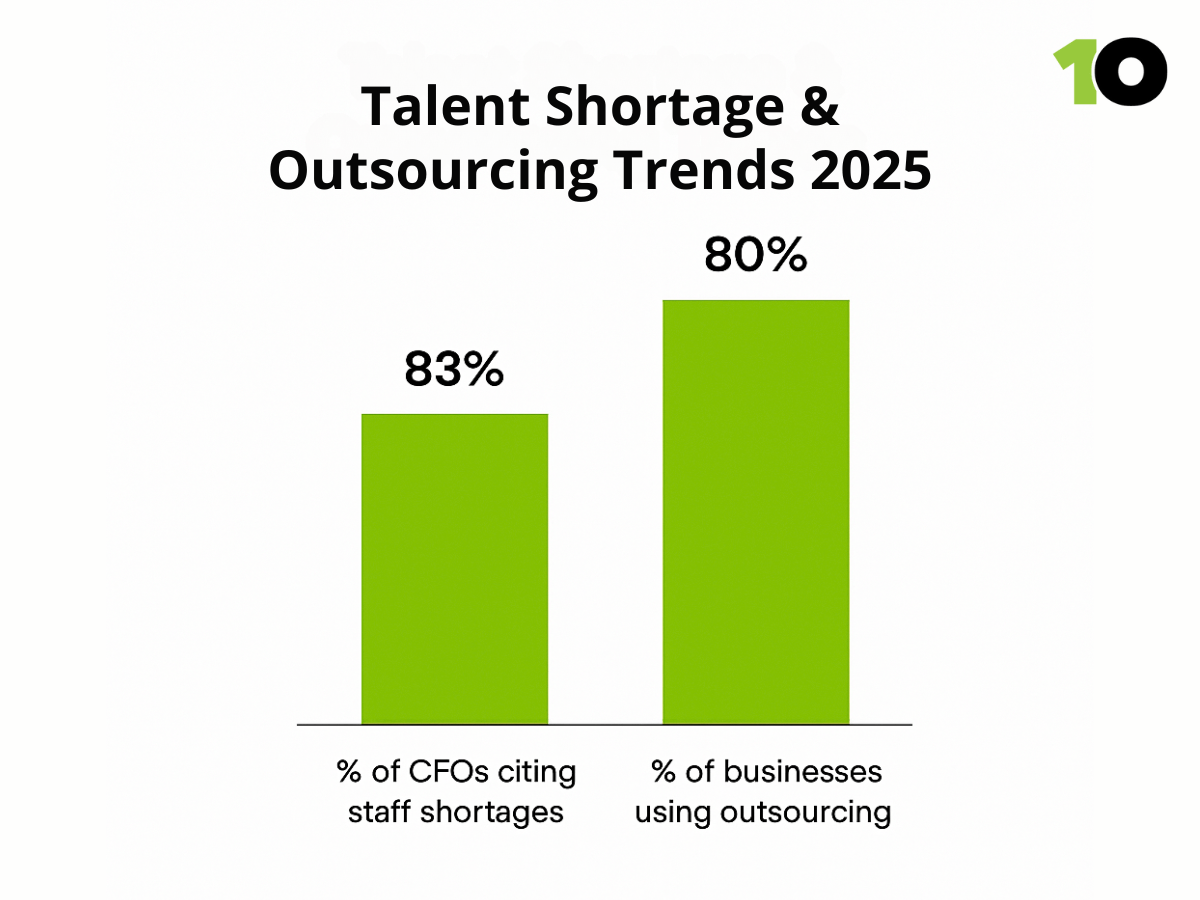

Demographic shifts are amplifying the challenge. By 2026, the accounting industry will face one of its steepest labor shortages in recent memory. In the U.S. alone, 75% of CPAs are expected to retire by 2030, and a similar generational turnover is occurring in Europe. The number of accounting graduates is not keeping pace, with enrollment declining in six of the top ten OECD countries over the past two years.

With 83% of CFOs citing accounting staff shortages as a major pain point, outsourcing has moved from a cost-saving tactic to a growth enabler. Globally, 80% of businesses now use third-party tools or outsourced providers for at least one accounting function, such as payroll, compliance, or invoice management.

In near future companies will need to prioritize automation where possible and invest in training programs that upskill junior employees in digital compliance, tax law, and client communication.

What clients want in 2026: insight, not just inputs

The traditional value proposition of accounting, recording transactions and submitting tax returns, is now expected as the bare minimum. Clients in 2025 and beyond want financial storytelling, scenario modeling, and proactive guidance. In a recent EY survey, 83% of clients said they expect their accountant to provide real-time advisory, not just historical data. Another 74% said they would switch providers for better digital reporting tools. This is especially true for international founders, many of whom operate without in-house finance teams. They need intuitive dashboards, email-based insights, and multilingual advisory support that helps them stay compliant without getting lost in paperwork.

1Office’s accounting clients consistently cite speed, clarity, and responsiveness as their top priorities, far ahead of price or service bundling.

Conclusion: strategic accounting in the AI era

The accounting profession is no longer a static industry. It is a strategic, compliance-critical service that is becoming more digital, more consultative, and more interlinked with every aspect of business growth. Between ESG disclosures, e-invoicing mandates, AI-powered workflows, and the ongoing talent exodus, firms must either adapt or be left behind. The winners in 2025 and 2026 will be those that combine automation with human insight, local expertise with global reach, and compliance with clarity.

Want future-ready accounting support in Estonia, Finland, Sweden, Lithuania, or the UK? Explore 1Office Accounting services.