Why Annual Report in Estonia Are Essential for Businesses

What Makes Annual Reports Vital in Estonia?

If you’re running a company in Estonia, there’s one document that holds a special place in the business landscape—the annual report. Annual report in Estonia are much more than administrative formalities—they are essential for legal compliance and building transparency with the Estonian Commercial Register. In fact, submitting your annual report in Estonia is your way of affirming that your business is playing by the rules in this dynamic and digital-friendly economy. Whether you’re a local entrepreneur or a non-resident, understanding the annual reporting process in Estonia is crucial for business compliance

Here’s the catch: submitting an annual report isn’t just a good idea; it’s the law. According to the Estonian Accounting Act, every single company—whether it’s actively trading or a dormant company taking a breather—must file their annual report by the prescribed deadline. Ignoring this legal obligation for annual report isn’t an option unless you enjoy penalties, fines, or even the dreaded removal from the Estonian Commercial Register.

Beyond compliance, a well-prepared annual report paints a picture of your company’s financial health, helping stakeholders, investors, and partners see the value you bring. For Estonian businesses, it’s more than just a requirement; it’s an opportunity to stand out in a competitive and fast-paced business ecosystem.

Whether it’s navigating annual report requirements in Estonia, tackling deadlines for annual report submissions, or seeking professional help with annual report preparation services, one thing is clear: this document isn’t just an obligation. It’s a reflection of how seriously you take your business.

With experts ready to assist with trusted annual report services in Estonia, preparing your financial statements has never been simpler. So, instead of grappling with spreadsheets, why not make your reporting process smooth, compliant, and worry-free? Contact 1Office’s trusted team for annual report services in Estonia today to ensure your company’s annual report is compliant, timely, and stress-free. Let us take care of the details, so you can focus on growing your business.

Legal Requirements for Annual Reports in Estonia

The Estonian Accounting Act and Annual Report

When it comes to financial compliance, the Estonian Accounting Act stands as the guiding force behind the preparation and submission of annual reports. This legislation lays out the framework that ensures businesses in Estonia operate transparently, providing accurate financial data for both stakeholders and regulators. Every company registered in Estonia—whether large or micro-companies, active or dormant—is subject to its provisions, making the preparation and submission of annual reports a non-negotiable requirement.

One of the key roles of the Estonian Accounting Act is to outline the format and content of annual reports. It specifies what elements must be included, such as the balance sheet, income statement, cash flow statement, and management report, as well as any additional notes required to provide full clarity on the company’s financial standing. The reports must be prepared in accordance with Estonian GAAP (Generally Accepted Accounting Principles) and submitted in Estonian and Euros. Compliance with these rules helps ensure that the financial data presented is both standardized and easily understandable.

Tailored Reporting Obligations by Company Size

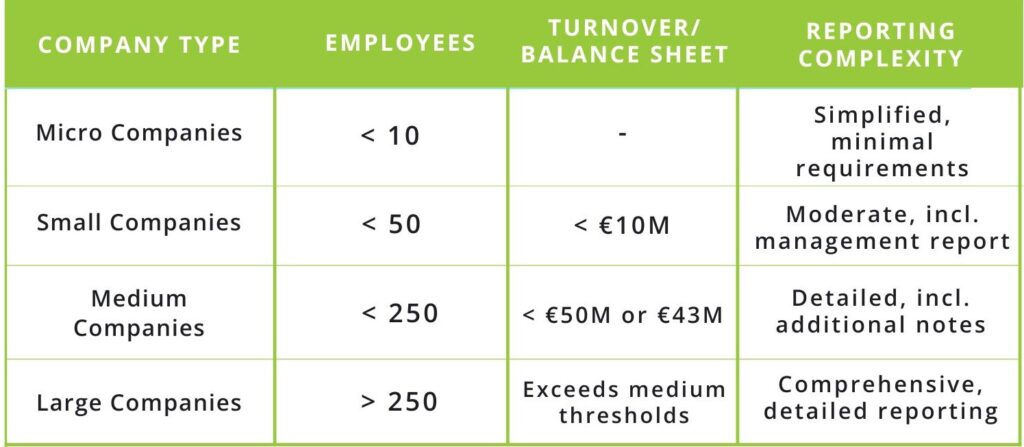

The Act also categorizes companies into four main types—micro, small, medium, and large—each with varying levels of reporting obligations. Here’s how they break down:

A clear visual breakdown of reporting obligations for Micro, Small, Medium, and Large companies in Estonia under the Estonian Accounting Act.

By tailoring reporting requirements to the size and scope of a business, Estonia strikes a balance between ensuring transparency and avoiding undue administrative burdens on smaller entities. However, no company is exempt from filing altogether, ensuring that even dormant companies comply with the country’s strict reporting standards.

Failing to meet these annual report requirements in Estonia can result in heavy penalties, from fines to removal from the Commercial Register, making it imperative for businesses to take their obligations seriously.

Key Components of an Annual Report

Behind every successful business lies a story—one that unfolds not only in meetings or contracts but also in financial statements. In Estonia, the annual report acts as the narrative that brings your business’s financial year to life. It’s the tool through which companies communicate their financial health and operational outcomes, ensuring full transparency to stakeholders and compliance with Estonian GAAP (Generally Accepted Accounting Principles).

Let’s take a closer look at the mandatory components that make up an annual report:

- Management Report: The management report is the story behind the numbers. It provides a qualitative overview of the company’s activities, achievements, and goals during the financial year. Companies must also discuss potential risks, challenges, and strategies for the future. This section is critical for investors, creditors, and other stakeholders to understand the broader context of the financial data.

- Balance Sheet: The balance sheet showcases the company’s financial position at the end of the financial year. It summarizes the assets, liabilities, and equity, providing a snapshot of what the business owns versus what it owes. This component helps evaluate the company’s stability and liquidity.

- Profit and Loss Statement (Income Statement): Here lies the summary of the company’s financial performance. The profit and loss statement details revenues, expenses, and profits (or losses) over the financial year. It’s invaluable for understanding the company’s profitability and operational efficiency.

- Cash Flow Statement: Cash is king, and the cash flow statement tracks its movement in and out of the business. This section is essential to understanding the company’s liquidity, showing how well it generates cash to meet its obligations.

- Notes to the Financial Statements: The notes offer the fine print—critical explanations and additional details about the numbers presented. Whether it’s accounting policies, valuation methods, or unique transactions, this section ensures the report is both transparent and informative.

Deadlines and Penalties for Non-Compliance

When it comes to filing annual reports in Estonia, time is of the essence. The deadline is crystal clear: six months after the end of the financial year, which for most companies falls on June 30 2025. Missing this crucial deadline can result in significant consequences, as Estonia takes financial reporting obligations seriously.

What Happens If You Miss the Deadline?

- Fines and Financial Penalties Late submission of an annual report can lead to fines imposed by the Commercial Register. The longer the delay, the higher the financial penalties, creating unnecessary strain on your business.

- Warnings and Legal Notices Continued failure to submit the report may result in formal warnings and legal notices. These warnings are not to be taken lightly, as they signal that your company is at risk of further repercussions.

- Removal from the Commercial Register If the annual report remains unfiled for an extended period, the Estonian Commercial Register can take the drastic step of removing your business from the register altogether. This means your company effectively loses its legal status in Estonia, halting operations and damaging your professional reputation.

- Impact on Business Reputation Non-compliance reflects poorly on your company. Stakeholders, including investors and partners, may view your business as unreliable, affecting future growth opportunities and collaboration prospects.

Submitting your annual report in Estonia on time not only safeguards your company against these penalties but also helps maintain a strong and trustworthy reputation in the business community. If the process feels daunting, why not let the experts handle it?

At 1Office, we specialize in making the annual report process seamless and stress-free. From keeping you on schedule to preparing precise financial statements, we’ve got you covered. Don’t let deadlines become a headache—reach out to 1Office today and ensure your business stays compliant, protected, and in good standing.

How to Prepare and Submit Annual Report in Estonia: Step-by-Step Guide

Navigating the annual report submission process in Estonia might seem daunting, but with the right approach, it can be smooth and straightforward. Here’s a step-by-step guide to help you through the process, including everything you need to know about preparing and submitting your report via the e-Business Register.

Step 1: Gather Accurate Financial Data

The backbone of any annual report is accurate, reliable financial data. Ensure you have the following information readily available:

- Income statements (profit and loss data)

- Balance sheet (overview of assets, liabilities, and equity)

- Cash flow statement (tracks the movement of funds into and out of your business)

- Supporting documents, including invoices, receipts, and bank statements.

Even minor inaccuracies can raise red flags during compliance checks, so double-check your numbers before proceeding.

Step 2: Draft the Report

With your financial data in hand, begin preparing the components of the report:

- Management Report: Include an overview of your company’s activities during the financial year and any future plans or risks.

- Financial Statements: Prepare the balance sheet, income statement, and cash flow statement.

- Additional Notes: Explain any special transactions, accounting methods, or contextual details to give clarity to stakeholders.

Use Estonian GAAP (Generally Accepted Accounting Principles) as the standard framework for compiling your report, ensuring accuracy and compliance with local regulations.

Step 3: Prepare the Report in the Correct Format

To avoid rejections, annual reports in Estonia must strictly adhere to format requirements, including Estonian language and Euro currency standards. This ensures consistency across reports submitted to the Commercial Register and accessibility for local authorities.

Step 4: Access the e-Business Register

Log in to the e-Business Register. You’ll need access credentials, usually in the form of: Estonian ID-card, Mobile-ID, or Smart-ID. The e-Business Register is Estonia’s efficient digital platform for annual report submissions, making the process seamless for both residents and e-Residents.

Step 5: Submit the Report and Receive Confirmation

After submission, you’ll receive confirmation from the e-Business Register that your report has been filed. Keep this acknowledgment for your records—it’s proof of compliance and may be required in the future.

The Importance of Accuracy

Submitting an annual report isn’t just about ticking a legal box. It’s about presenting your company’s financial story with clarity and precision. Errors or discrepancies could lead to fines, compliance issues, or a poor reputation with stakeholders. Preparing accurate reports with proper supporting documents is crucial to avoiding unnecessary complications.

Annual Reporting for Dormant Companies and Non-Residents in Estonia

Simplified Reporting for Dormant Companies

Even if your Estonian business hasn’t been active throughout the financial year, you’re still required to submit an dormant company annual report in Estonia to maintain compliance. For dormant companies, however, the process is significantly less demanding. Since a dormant company has no financial transactions—other than the share capital recorded upon its registration—the reporting requirements are simplified.

In practice, this means:

- The financial statements will only include a balance sheet reflecting the share capital, as no income, expenses, or other financial activity occurred.

- No management report or cash flow statement is required.

- Notes to the financial statements may still be necessary to clarify the dormant status of the company.

This streamlined process allows dormant companies to fulfill their legal obligations without the same level of documentation as active businesses. Despite the simplicity, meeting the reporting deadline remains crucial to avoid penalties or removal from the Estonian Commercial Register.

How Non-Residents Can Fulfill Reporting Obligations

For non-residents managing businesses in Estonia, submitting an annual report can seem challenging—especially if they don’t possess an Estonian ID card. However, Estonia’s advanced digital infrastructure provides solutions to bridge this gap.

Here’s how non-residents can fulfill their reporting obligations:

- Use an e-Resident Digital ID: Non-residents can apply for Estonian e-Residency, which grants access to the country’s digital services, including the e-Business Register.

- Delegate to a Local Representative: Non-residents can also appoint a local representative. This option is particularly useful for those who prefer not to apply for e-Residency or need comprehensive support.

- Utilize Third-Party Assistance: Companies like 1Office specialize in assisting non-residents with preparing and submitting annual reports. From crafting accurate financial statements to navigating the nuances of Estonian regulations, these services ensure compliance without the need for direct access to the country’s digital systems.

With these options, non-residents in Estonia can ensure their businesses remain compliant with local laws while overcoming the logistical challenges of digital submission.

Outsourcing Annual Reports in Estonia: Professional Help for Businesses

Are you ready to make annual report preparation stress-free? At 1Office, we specialize in handling the entire process for you—from bookkeeping to financial statement preparation, and ensuring your report is compliant and submitted on time.

Whether you’re a small startup, a dormant company, or a growing enterprise, our experts are here to simplify the process and keep your business in good standing. With years of experience in annual report services in Estonia, we’ve helped countless businesses navigate their reporting obligations with ease.

Visit accounting services or contact us today for personalized assistance. Let us handle the details, so you can focus on what matters most—growing your business!