So, you decided to start a business in Estonia and are about to register a company here. Understanding the various company types in Estonia is essential for making the right decision.

Should you register a branch of your existing company or start a new one? What is the difference between a private limited company (OÜ) and a public limited company (AS)? Is there a specific type for solopreneurs or freelancers?

In 2025, Estonia remains one of the most business-friendly environments in Europe. Whether you’re an entrepreneur, freelancer, or expanding company, choosing the right company type can have a significant impact on your business operations, taxation, and liability. Let’s explore the options that work best for your needs.

The main legal business forms in Estonia are:

- Private limited company (OÜ)

- Public limited company (AS)

- General partnership (TÜ)

- Limited partnership (UÜ)

- Branch of a foreign company

- Sole proprietorship (FIE)

- Non-profit organization (NPO/MTÜ)

- Commercial association (ühistu)

So, let’s have a more detailed look at some of the most common options.

Private limited company (OÜ) – the most popular company type in Estonia

Usually, the most popular choice while registering a new company is a private limited company (OÜ).

What to keep in mind when founding an OÜ in Estonia?

Private limited company (OÜ) remains the most popular of all company types in Estonia. Especially for small to medium-sized businesses. Thanks to Estonia’s digital-first approach, e-residents and non-residents can easily establish and manage their companies remotely. Minimum share capital is 0,1€. The amount of initial capital is decided by the founders depending on the capitalization needs of the company. Capital must be paid and declared in tax office upon registration of the company. Shareholders’ personally liability is limited to the amount on their capital contribution.

The management board must include at least one person. This means that you personally can be the management board. As many countries require at least two persons to be on the management board or at least one of the directors to be local, this easy rule makes it much easier to start a business in Estonia. Therefore, many companies in Estonia (especially those that are founded by e-Residents) have only one board member and employee, the e-resident himself/herself! This flexibility is why OÜ is the recommended option for 90% of new businesses in Estonia.

OÜ is a perfect choice when setting up a small or medium-sized business as an e-resident or non-resident. Here you can also find a full guide to starting a business in Estonia that is focused on starting an OÜ.

Main facts about the private limited company (OÜ):

- The minimum share capital is 0,1 €.

- Liability is limited to the share capital that was paid into the company.

- Board must include at least 1 person and there are no special requirements for that person.

- Accounting requirements depend on the activities of the company. If the company registers a VAT number or pays salaries to employees, monthly accounting is necessary. If not, the accounting can be done once a year with an annual report.

Public limited company (AS) – for larger businesses in Estonia

Public limited company (AS) in Estonia is a company type and option for one or more either natural or legal persons, usually with a share subscription (but also possible without a share subscription).

For larger organizations in Estonia, the public limited company (AS) is an important option among the available company types in Estonia. With a minimum share capital requirement of €25,000, AS is suitable for large-scale businesses aiming to go public or manage multiple shareholders. The supervisory board ensures transparency and accountability, making it an excellent choice for larger corporations or those planning expansion through share subscriptions.

Main facts about the public limited company (AS):

- The minimum share capital is 25 000 €.

- Liability is limited to the share capital that was paid into the company.

- In addition to a regular management board, it requires a supervisory board (consisting of 3 members who are elected by the shareholders) and an auditor.

- Monthly accounting is mandatory.

General (TÜ) and Limited partnership (UÜ) – traditional business types in Estonia

A general partnership is a specific type of company between two or more partners. They operate under a common business name and are solidarily liable for the obligations with all of their assets. Unlike an OÜ or AS there is no minimum share capital.

These company types are suited for partnerships where trust and mutual liability play a key role. In a general partnership (TÜ), all partners share equal responsibility for obligations, whereas in a limited partnership (UÜ), limited partners benefit from liability restricted to their share contributions. These are niche options, often chosen for specific industries or joint ventures.

Main facts about the general partnership (TÜ) and limited partnership (UÜ):

- No minimum share capital.

- The members are personally liable for the obligations.

- Consists of partners – either equal (TÜ) or not equal (UÜ).

Branch of a foreign company – expand Internationally in Estonia

As always when expanding to foreign countries, it’s possible to register a branch in Estonia and run your business through it. Of course, that means you have to have an existing company in your home country (or any other country).

In 2025, registering a branch of a foreign company in Estonia has become even simpler with enhanced digital tools. E-residents can manage their branches entirely online, avoiding the need for physical visits. A branch provides the perfect solution for companies looking to expand operations internationally. Among the various company types in Estonia, it allows foreign entities to establish operations while remaining tied to the parent company. Keep in mind that the liabilities of the branch remain tied to the main company.

Keep in mind that: If you intend to offer services or sell goods in Estonia on a permanent basis and you plan to do it with your foreign company, you have to register the company as an official branch.

Main facts about a branch of a foreign company in Estonia:

- Share capital is not needed.

- It’s not a separate legal entity, therefore the main company is liable for its obligations.

- Board must consist of a separate director or directors of the branch.

- The main company must maintain separate bookkeeping accounts for the branch.

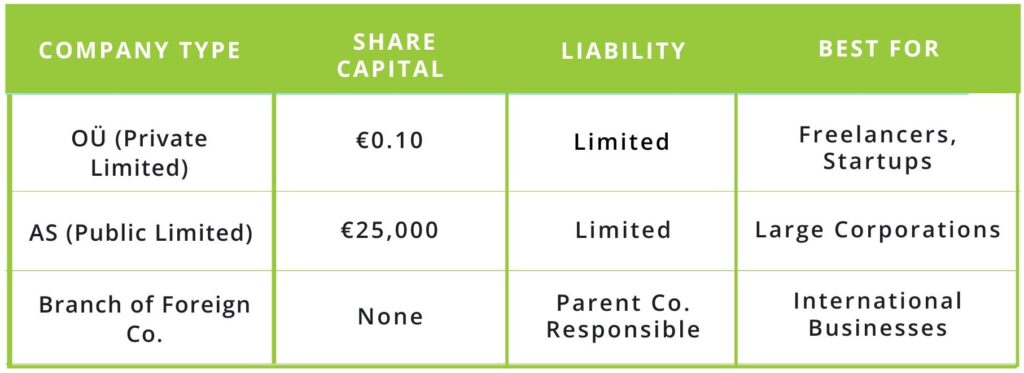

A side-by-side comparison of the main company types in Estonia, highlighting their share capital requirements, liabilities, and suitable use cases.

Sole proprietorship (FIE) – not the best option for foreign entrepreneurs

Sole proprietors are persons who are offering their services or goods under their own personal name and are not legal entities. It however creates a different taxation system for these persons and therefore it is not a good option for foreign entrepreneurs and e-residents.

Even if this option seems appropriate for freelancers it’s actually not because sole proprietors are fully liable for any obligations and the tax logic behind this option is not suitable to foreigners. Solopreneurs and freelancers have much more to win from establishing a one-man private limited company (OÜ).

Main facts about sole proprietorship (FIE):

- Share capital is not needed.

- The person is personally liable for the obligations.

- No shareholders and no board.

- Accounting requirements depend on the activities exactly as with an OÜ. If the FIE registers a VAT number or pays salaries, monthly accounting is necessary. If not, the accounting can be done once a year with an annual report.

Non-profit organization (NPO/MTÜ) – a unique company type in Estonia

With a non-profit organization, the main goal can’t be to earn profit, therefore the taxation applying to NPO’s is a bit different. Overall, a non-profit organization works similarly to a private limited company (OÜ), meaning that it can still hire employees, open a bank account, and have expenses. But it can’t distribute profits amongst its members.

Also, with this type of company, there’s an extra requirement – at least half of the board members must reside in Estonia, Switzerland, or EEA. Non-profit organizations are regulated by the official Non-profit Associations Act.

Company types in Estonia – choose the right one!

In conclusion, there are several company types in Estonia to suit a variety of business needs, from small startups to large corporations. In most cases, choosing an OÜ will provide the simplest and most flexible solution for small to medium-sized businesses, freelancers, and e-residents. For larger enterprises or unique circumstances, exploring options like AS, general partnerships, or branches might suit your needs better. If you’re uncertain, we recommend seeking our professional legal consultation to ensure you select the right company type. Estonia’s streamlined digital processes make starting a business quick and hassle-free—begin your journey here.

In case you have found your answers, just follow these easy steps to register your company in Estonia.