Why this matters for businesses in Finland

Starting in August and November 2025, the Finnish Tax Administration will implement major changes to how business taxes are paid and refunded. These updates aim to reduce administrative burden, improve transparency, and make tax management more predictable for companies.

At 1Office, we specialize in helping businesses navigate regulatory changes across Europe. Here’s a breakdown of what’s changing and how your company can benefit.

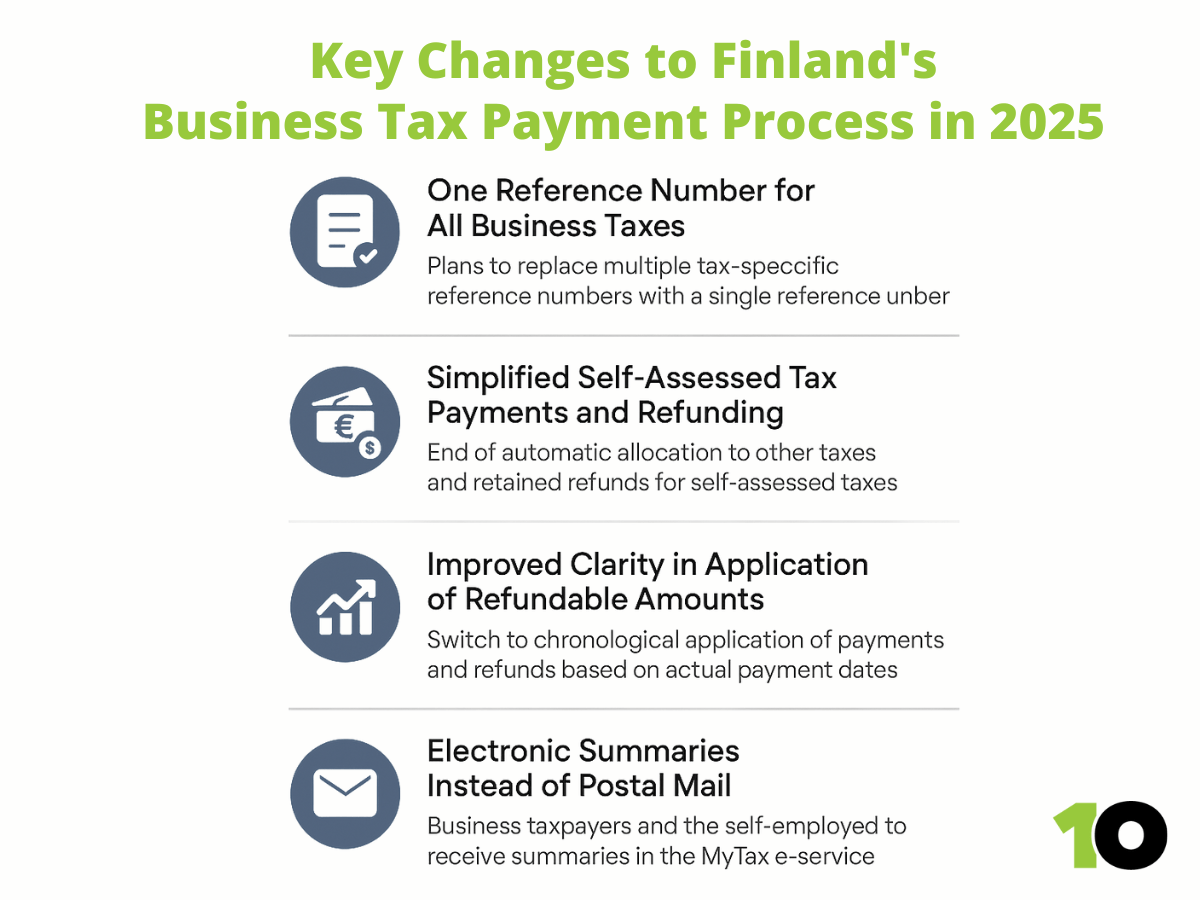

Key changes to business tax payments in Finland

1. One reference number for all business taxes

Current issue: Businesses must use different reference numbers for each tax type: VAT, corporate tax, employer contributions, etc.

New solution:

- A single reference number will replace multiple tax-specific codes.

- Payments will be applied to outstanding tax debts in chronological order, starting with the oldest.

Benefit: Fewer errors, simplified accounting, and reduced time spent on tax administration.

Note: This change applies only to business taxpayers. Sole traders and agricultural operators will continue using separate references.

Finland business tax changes, Finnish Tax Administration 2025, business tax payment reform, self-assessed tax refund Finland, MyTax updates 2025

2. Streamlined self-assessed tax payments and refunds

Self-assessed taxes include:

- VAT

- Employer contributions

- Excise duties

What’s changing:

- Payments will no longer be reallocated to other tax types at month-end.

- Refunds will be issued automatically, no need to request retention.

- Credit balances won’t earn interest before the due date, but refunds will still include interest.

Effective date: Refund retention option removed from MyTax on 19 August 2025.

3. Chronological application of refunds

Old system: Refunds from one tax category couldn’t be used to cover another tax due around the same time.

New system:

- Payments and refunds will be applied based on the actual date received.

- This ensures fairer treatment and avoids unnecessary payments.

4. Digital summaries via MyTax

Current practice: Over 1.2 million paper summaries are sent annually.

New approach:

- All summaries will be available exclusively in MyTax.

- No more paper mail: just secure, digital access.

Benefit: Faster access, reduced paper waste, and improved user experience.

Implementation timeline

| Change | Effective Date |

|---|---|

| Refund retention removed from MyTax | 19 August 2025 |

| Full reform implementation | November 2025 |

What this means for your business

These reforms are more than just administrative tweaks. They represent a shift toward greater efficiency, transparency, and predictability in Finland’s tax system. For businesses, this means:

- Fewer errors and missed payments

- Faster access to refunds

- Easier compliance and reporting

At 1Office, we’re here to guide you through every step. Whether you’re a Finnish company or an international business operating in Finland, our experts can help you adapt to these changes and optimize your tax strategy.

Stay informed with 1Office

We’ll continue to monitor updates from the Finnish Tax Administration and provide timely insights. If you have questions or need support preparing for the new system, don’t hesitate to reach out.

Let’s make 2025 the year your business spends less time on tax admin and more time growing. Find out how we can help.