If you have found a great product or service that you want to sell online, you have definitely been thinking about e-commerce. But as the e-commerce business is a massive sector that is booming, there are many questions you need to think about, and with every answer, more questions arise. The main administrative one being: where should you start a company to manage your e-commerce business? To make your life just a bit easier, we have put together a thorough guide about starting an e-commerce business with a UK company – all the main benefits, reasons, requirements and processes. So, let’s get going:

5 reasons why to start an e-commerce business in the UK

Even if you have found a perfect product or service and put together a business plan, one of the most daunting questions before starting can be how to set your business up. Of course, much depends on your potential buyers and goals, but if your dream is to sell internationally, the best option would be to choose an international market as your base. And what would be a better international market than the UK – a place where setting up the company as a foreigner is one of the easiest things and where most of the e-commerce marketplaces have their warehouses. But before jumping to conclusions, let’s look into starting an e-commerce business in the UK in more detail.

1. A big market with even bigger opportunities

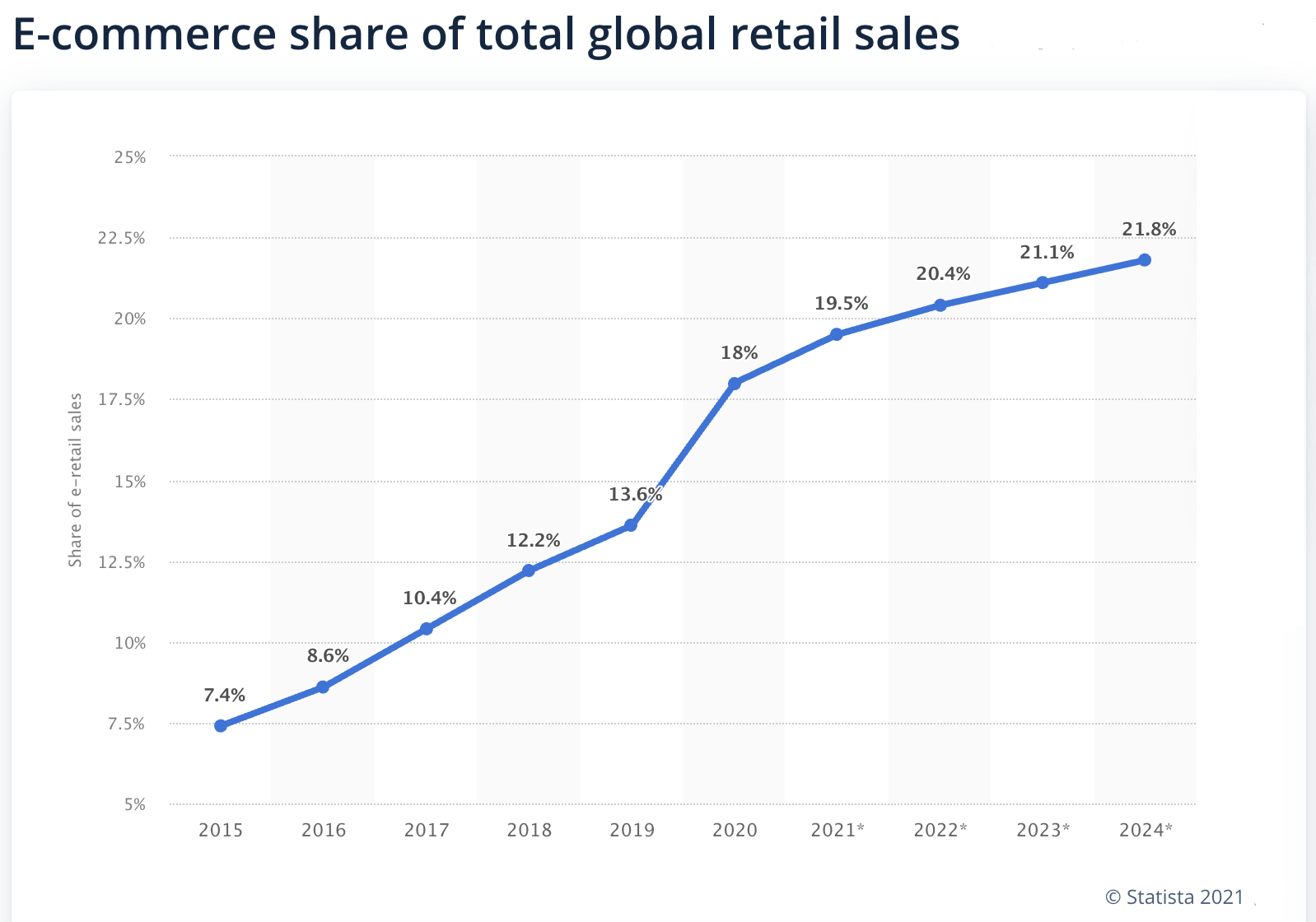

Our shopping preferences have changed a lot during the last decades and even years. When in the 2000s, all of the shopping was done in physical shops, then in the 2010s, this started to change, and the first years of the 2020s have shown that e-commerce plays the leading role in the UK’s economy. It is even studied that e-commerce business makes more than 20% of all retail sales worldwide and more than 25% of all retail sales in the UK. Basically, with the opportunity to sell products and services online, the sky’s the limit for potential success.

Furthermore, if we look into how popular e-commerce is in the UK, we can easily find that nearly 90% of Brits use Amazon, and there are 21 Amazon FBA distribution centres in the UK. The same success is seen in the main e-commerce platform Shopify that increased its market share in the UK and now hosts a total of 120 000 UK businesses.

These numbers speak for themselves and show well how big of an e-commerce market the UK is. Still, if you need some more convincing, it can’t be underestimated that UK companies are traditionally well trusted and show better international trustworthiness than companies founded in some not-so-known countries. Also, the English language is a great bonus as it’s easier to set everything up and communicate with different instances and authorities in their native language. The time zone of the UK is also quite favourable for all of Europe and most of the world.

Another good thing about starting a business in the UK is that there are endless options regarding partners and suppliers. If you wish to find a specific company that you can partner up with or are looking for good suppliers on an ongoing basis, then the UK market offers plenty of choices. Whatever you need, there’s someone who can offer it. And most importantly, UK businesses have a high number of potential buyers, both inside and outside the UK.

Regarding taxes, the UK is also quite favourable for starting a business, even as a foreigner. If you wish to learn more, have a look at our blog post about the UK tax system in general or check the specific tax rates here.

2. Start and manage everything online

One of the best things about starting a company in the UK is that you can set up everything fully online and without any extra hassle. It doesn’t matter if you are inside or outside the EU. Company registration for non-UK residents is the same as for residents living in the UK, and there are no restrictions on foreign nationals being a UK company director, shareholder, or secretary. You don’t even have to live in the UK. However, the company will need to be officially registered with the Companies House.

The state fee for the incorporation is only £12, and the only complicated part is getting your incorporation documents correctly filled. But if this is something you don’t feel comfortable doing alone, many companies, including 1Office, can offer professional help with your forms and applications. We even have a secure portal designed, where you can fill all the necessary documents in one place and even add banking options, accounting and address service with a few clicks. This simplifies the process a lot and lets you manage your company fully online in the future as well.

As already mentioned, address service is something your company needs if your business is not physically operating in the UK. Every company registered in the UK needs to have a UK address – this address will be shown on the Companies House register, and all official correspondences from HM Revenue and Customs (HMRC) and Companies House will be delivered to this address. Furthermore, directors of the UK company must register their address on the public record, and this address serves as the official contact address for the individual where they receive official mail. As this information is publicly available to everyone, many business owners choose to order the director’s service address as well because this helps to keep their home address private. Fortunately, both these services are really affordable, starting from around £10 per month.

All this makes managing your online company a really good place to save money as you don’t even need to have an office space – you can work from home and save money on rent and supplements. And with operating an e-commerce business, you also save money on even bigger rent bills and supplement costs as you don’t need physical stores to sell your products, everything is done online!

3. UK private limited company is a low-cost option for your e-commerce business

Starting an e-commerce business in the UK begins with establishing a private limited company. So, as we already discussed, a UK company is perfect to manage online, but not only that, it also has really reasonable costs. Let’s start from one-time costs – basically, the only one-time cost is the company formation itself. If you wish to use professional help, with 1Office, the incorporation price is £50, which already includes the state fee.

Moving forward to recurring costs, you have to submit annual accounts once a year, even if the company has no activity during the accounting period. The exact price depends on the work volumes, but small and medium companies usually consider paying around £600-800 per year. If your company also needs monthly declarations, you can choose a suitable accounting package that covers all your needs. With e-commerce, one important thing is to check if and how much the accounting company you hire will charge you for growing volumes.

Of course, you can try to do the accounting yourself, but unfortunately, sellers across the world find it challenging to meet the reporting and accounting requirements without using an external expert. This generally leads to increasing accounting costs as transactions increase. But there are service providers who can offer fixed accounting costs for sellers, and we are happy to mention that 1Office is also one of them.

Another recurring cost that we already mentioned earlier is the address service.

Let’s mention a couple of other good things about UK private limited companies:

- Unique share capital rules – Private limited companies are required to have a minimum share capital of just £1, and profits made can be distributed to the shareholders in the form of dividends.

- Limitation of liability – The company is a separate corporate body from the individual, so personal assets remain separate, and your personal risk is minimal. Liability for payment of the debt stops with the company.

What’s more, with e-commerce, depending on the product or service you choose to sell, you may not need to make big investments to get things running. You can start with a small number of selling articles and even do some AB testing before fully committing. This means that in addition to low company-related administrative costs, you can also start the real activities with low investments and move forward from that.

4. With a UK company, you can easily choose between different e-commerce platforms

Before looking into the details, let’s start with some easy explanations about different e-commerce options. The most important thing to remember is that Amazon, eBay and AliExpress are online marketplaces where you can set up your account and sell your products, while Shopify is a specialised e-commerce platform. This means that Shopify gives you the tools to build your very own online store from scratch, while others let you sell through their marketplaces (for certain commission, of course) alongside other online sellers.

So, selling on different marketplaces basically equals having a stall in a famous fair – you have lots of people walking by and browsing your products, but they are not particularly looking for your brand, they find you by chance. As there are many people browsing, you also get a fair amount of sales, but you also have to pay the fair organiser for renting your stall. With Shopify, on the other hand, it’s like renting a private shop and selling your products there – customers come specifically looking for you and your products. Still, it’s definitely more difficult to create a regular customer base as you need a strong brand and marketing.

You should keep in mind that different marketplaces also have different orientations – Amazon is usually used for new products, eBay mostly for used products and AliExpress mostly for Chinese-made or low-priced products. Therefore, many e-commerce sellers who want to start selling their new products choose Amazon.

The most popular way to set up your e-commerce business on Amazon is Fulfilment by Amazon (FBA). With FBA, the process starts with you sending your products to Amazon for storing. When someone orders your products, Amazon is the one handling all the packaging, delivery and returns while you pay some additional storage and fulfilment fees. This is the most convenient way to sell if your business is still quite small, and having a separate warehouse and employees doesn’t make sense.

With Shopify, you will build your own online store, but this process will be really easy thanks to their clear navigation, help pages, countless design options and in-depth sales tools. The coolest tools include logo maker, business name generator, inventory system, abandoned cart recovery, automatic tax calculation and app integration. Compared to selling on marketplaces, Shopify will give you the freedom to create something from scratch (with the help of their easily navigated themes).

But why is it easy to do it specifically with a UK company? Well, with the UK company (that you will have established in just a few days, by the way), you have an easy option to upgrade it to be eligible for any e-commerce platform. You primarily require a local VAT number in order to be a successful e-commerce seller, and for that, you will need to provide proof that you are starting your sales in the UK soon or even better if you already have some UK customers. After that, you are ready to open your e-commerce store. What’s even better, to drop ship products within the UK (meaning buying from the UK warehouses and selling only to UK clients), you don’t even need the VAT number registration.

Whether you choose to opt for an Amazon marketplace or to build up a store with Shopify, 1Office can be your best friend in this process. We have strong competence in company incorporation, VAT registration, and bookkeeping. We even offer comprehensive starting packages for both Amazon and Shopify (including a company, VAT process, business banking options, reporting/bookkeeping services and more). You can read more about these specific packages at the end of this article or contact us right away to get more information.

5. Many good options for business banking and payment gateways

With a UK company, you’ll have access to a wide range of fintech and online bank solutions. To list some of them:

- Payoneer

- Wise (previously TransferWise)

- Revolut

- N26

- Paysera

We at 1Office have partnered up with Payoneer and Wise in order to offer the best solution for all our clients. Payoneer is a perfect choice for Amazon sellers as they are an industry-leading global payments company that provides cross-border payments and is the official payment partner for Amazon globally. And Wise is a good choice if you decide to go with Shopify or create a separate website. Either way, if you are establishing a private limited company, a business banking account is something you’ll need to run your business and luckily, with a UK company, you’ll have many good choices.

In addition, you might need a payment processing solution. With Amazon, you don’t have to worry about setting up your own payment gateway as Amazon has already set everything up with their own Amazon Pay. But choosing a payment gateway is vital when setting up your own store. You can set up your website, but to start selling, you’ll also need some way of accepting credit and debit card payments.

With Shopify, you’ll have the option of choosing what payment options you want to enable. The easiest is Shopify Payments, but this is unfortunately supported only in a few countries. Luckily the UK is one of them, but if your business is operated from somewhere else, you should check the supported countries list. If you are not eligible for this option, Shopify also supports over 100 third-party payment providers, To name some of the most popular ones that are available for UK companies:

- PayPal

- WorldPay

- SagePay

- Paysera

- Skrill

- 2Checkout

- and many, many others.

Of course, each of these providers have their own transaction fees and rules, but this is something you can figure out and choose the best one for your business after the account has been created. At least with a UK company, you don’t have to worry about finding the right one as there are so many choices that everyone will find their best fit.

So, how to start an e-commerce business in the UK?

We have looked over the main reasons why you should start your e-commerce business in the UK. If these reasons make sense to you and you feel that managing an e-commerce business through a UK private limited company is reasonable, here are some first steps you should take:

- Choose the main product or service you want to sell – there doesn’t have to be a full spectrum of articles available right away. If you want to keep initial investments low, you can start small, with only a couple of products and move forward from that.

- Do your research – get familiar with the market and your main competitors. Be sure to map out who your main buyers will be and how to address them the best.

- Choose your company’s name, structure and prepare your business plan.

- Choose where and how you want to sell – do you want to start your own online store and use an e-commerce platform like Shopify to simplify this process, or do you want to sell on a marketplace like Amazon without setting up your own e-shop.

- Start the incorporation process in the UK and set up share capital, address service, VAT and accounting for your company.

- Alternatively, if you want to focus on your business and let someone else take care of the juridical and administrative side, contact some professionals like 1Office, who can help from start to finish.

As already mentioned, 1Office can help you with company formation, address service, VAT registration, bookkeeping, annual accounts, and we also offer many additional legal services. Furthermore, if you plan to start your business on the Amazon marketplace or with Shopify, we can also offer a full package.

What packages does 1Office offer for e-commerce sellers?

Our Amazon package for UK companies includes:

- EU company in the UK – Everything to establish a company will be handled by 1Office, including the mandatory state fee, filing of application through the registry, the requirement to have a registered address and director’s service address, etc.

- Business banking account with Payoneer – Payoneer is an industry-leading global payments company that provides cross-border payments and is the official payment partner for Amazon globally. 1Office has officially partnered with Payoneer so our clients can easily create their accounts and even get special incentives.

- VAT registration and reporting – Amazon requires all European FBA sellers to be registered for VAT. The package includes the cost and processing of registering for VAT, and more importantly, the cost of VAT reporting, which is mandatory to ensure smooth operation of the business.

- Accounting service – It is essential for companies to ensure regular accounting and avoid financial challenges. Besides this, all sellers can actually reduce accounting costs with this package since the cost remains fixed regardless of growing sales volumes if some main requirements are met.

- You’ll need to register for the Amazon seller account yourself, but an expert from 1Office can offer our competence if you run into any trouble. However, please bear in mind that Amazon is strict with its rules. So before applying, please make sure that your ongoing cooperation/disputes (if there is any) with Amazon are resolved and your standing is good, otherwise, they might deny your application.

Our Shopify package for UK companies includes:

- EU company in the UK – Everything to establish a company will be handled by 1Office, including the mandatory state fee, filing of application through the registry, the requirement to have a registered address and director’s service address, etc.

- Business banking account with one of our official partners – you can choose between Payoneer or Wise (previously TransferWise) as we have officially partnered with both, so our clients can easily create their accounts and get special incentives.

- VAT registration and reporting – the cost and processing of registering for VAT, and more importantly, the cost of VAT reporting, which is mandatory to ensure the smooth operation of the business.

- Accounting service – It is essential for companies to ensure regular accounting and avoid financial challenges. Besides this, all sellers can actually reduce their accounting costs with this package since the cost remains fixed regardless of growing sales volumes if some main requirements are met.

- Shopify account registration and store set-up with a Premium theme (including custom template that you can use to design your store appearance easily) and transferring the account to the new owner.

If you are interested in either of the packages, feel free to contact us and get more information.

Conclusion

As you can see, the e-commerce sector is quickly growing, and there are many reasons to choose the UK for setting up your e-commerce business. We at 1Office are happy to help you in this process and offer many suitable solutions for different sellers across the world. If you are interested in our services, let’s chat and find the perfect solution for your case.