Being able to work remotely and have a location-independent lifestyle is becoming increasingly popular and commonplace.

People do not necessarily need to be at the office all-day, every-day and multiple studies have shown that remote workers can

perform equally well, if not better than their counterparts. Working location-independently minimises costs, increases

productivity and also leads to a better work-life balance in general.

Most of you reading this blog post might have already taken the leap or might be leaning towards exploring what it means to be location-independent. As is with everything in life, it has its pros & cons, especially since even though it is growing quickly, location-independence is still less widespread compared to other forms of conventional work culture. What’s even more is that while many influencers discuss ways of working remotely, not many focus on or are even aware of how to create a long-term & sustainable model to continue working location-independently.

As a result, many people who work location-independently today revert to the traditional 9 to 5 jobs after the so-called “phase of location-independence” in their life is over and having experienced this wonderful freedom in work & life, find it difficult to remain motivated in their personal or professional domains. The result is a mediocrity spiral which yet again pushes them to “experiment with location-independence” and so the cycle goes back & forth.

But why is it really that people go back from living location-independently? One of the main reasons is the sense of security which they derive from being part of a certain structure — earning an assured salary and following a fixed format of paying taxes, investments, etc., following a time-based employment contract, having routine bills to pay, etc. and knowing how much they can save every month to achieve various dreams and ambitions in life.

Unfortunately, this is not sustainable for everyone. Especially for people who are ambitious and talented, it is important to have freedom & independence to build something truly unique. As is with anything in life, it is important for those who work or plan to work remotely, to have a longer-term plan to instill a sense of security while remaining location-independent. By simply being a remote worker, employee, freelancer or digital nomad, people do not realise but they end up wasting a lot of time & money since present day laws & systems of governance which were implemented decades ago, simply aren’t geared to support location-independence.

So, before we delve deeper into the solutions for remote workers, let’s explore why it even makes sense to create a company to feel secure, have a longer-term sustainable model and as a result — truly achieve location-independence!

The difference between being a remote worker VS a remote entrepreneur

As a remote worker or employee, there are many additional responsibilities which you are left to plan on your own

- understanding & paying relevant taxes depending on where you are based, which can indeed be more complicated if you are moving around,

- registrations needed as a self-employed person or freelancer,

- managing foreign exchange conversions if you are paid in a different currency than the location where you are based

- and trying to manage these conversions in a manner that you lose the least amount of money, get the best rates, etc.

Even the largest remote-work platforms like TopTal, Crossover or even Upwork do not provide a tailor-made solution to manage these challenges, and who can blame them — it is indeed extremely challenging to provide the right advice for each remote worker especially as a number of them are based in multiple locations around the world or are constantly traveling. As a result, the majority of remote workers & employees end up utilising inefficient structures to manage taxes, convert foreign exchange, etc. and lose a large margin of their revenues which could have been put to better use in terms of savings or investment to grow individual financial positions.

What difficulties does a remote worker have?

As a remote entrepreneur however, these challenges do not seem so insurmountable anymore since a business is an artificial legal person and unlike the individual (remote worker or employee) is stationary and based in a stable legal framework. It might not immediately make sense why this is a huge advantage — so let’s just elaborate the benefits of having a separate company as a remote worker.

Firstly, it becomes much easier to manage incoming or even outgoing payments since the money could arrive into the account of your company. This also means that you would always receive money in a certain currency first — Euros, British Pounds, etc. and then you can decide how much money you need to pay yourself as a salary or a dividend payment (more on this later) depending on your needs and where you are based. For example, if you are living in Amsterdam at the moment, then of course you will need more money for your monthly expenses compared to if you were in Bali for that matter.

Building upon this example further, you might need to travel to Germany for a potential work opportunity — why should you be paying for this from your personal finances on which you already paid taxes? It makes more sense to pay for this through your own company since in reality, this is a business expense and in most jurisdictions business expenses are deducted before any corporate taxes are paid on the total revenues or profits. Most interestingly, managing taxes becomes much more efficient — let us imagine that 6 months in the year you decide to be based out of Bali — you would most probably end up falling in Band IV of the Indonesian income tax code and have to pay 30% tax on the entire monthly revenue you earn as a remote worker or employee but why should that be? Let us assume you earn about €5’000 every month through your remote work — this would mean that if you are living in Bali, you would end up paying €1’500 in personal taxes every month! To most people, €1’500 monthly is more than enough to live in Bali. So why should you be paying that much money in taxes alone?! If only you had a company which would receive €5’000 instead and then you could pay yourself a monthly salary of approximately €2’100, pay 30% tax (about €600) to receive €1’500, saving almost a 1000 euros in the process! And we are not even accounting for the foreign exchange costs you save here. To go even a bit further — maybe you do freelance projects on Upwork too and some of these projects require more than just your resources to execute but then again, also pay better. After a few months of saving the €1’000 you probably have enough money to even hire a few remote workers or freelancers part-time to execute larger projects.

One thing leads to another — and gradually you have your own micro-business running. You transition from being a remote worker to being a remote entrepreneur while changing almost nothing in the way your revenue-model works but just optimising it to suit your needs better and have a longer-term & sustainable financial model which also provides you more security to continue your life’s journey as you want to!

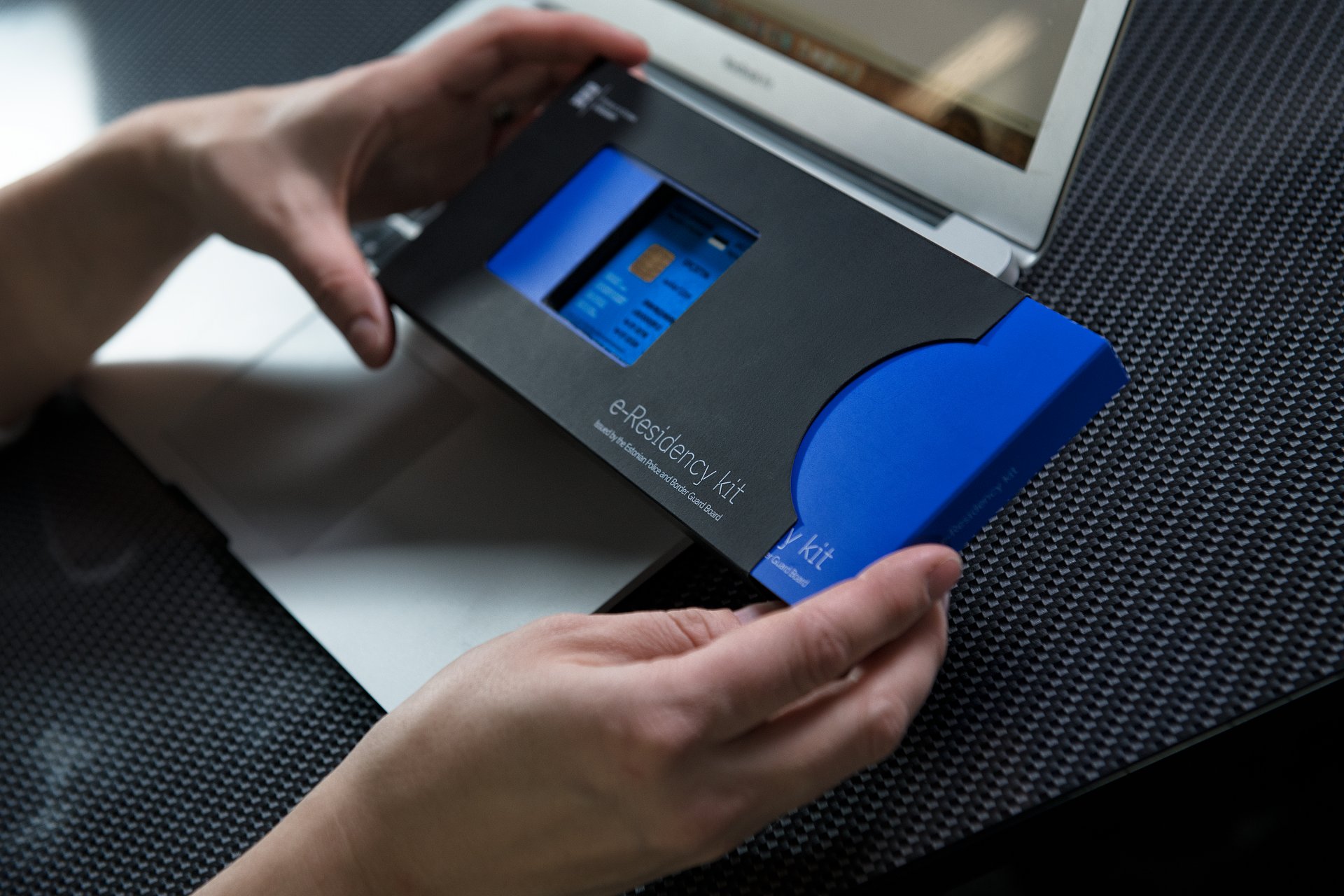

BUT WAIT — what about all the bureaucracy and high costs associated with establishing a company first and then managing it? Well, that’s where we would like to introduce e-Residency and 1Office.

The solution: E-Residency & 1Office

1Office is a company based in Estonia with offices in 6 countries across Europe and has been one of the earliest private sector partners of the rather well-known e-Residency program by the Government of Estonia. Today, 1Office is one of the top service providers for e-Residency and recently also launched a rather unique technology solution which allows anyone to use the 1Office online portal and create & manage a company and remote employees in a matter of minutes, at a fraction of the cost.

E-Residency is a unique initiative by the Government of Estonia, a full member of the EU, OECD, Eurozone, Schengen region, WTO and all such globally important clubs. Estonia is known around the world for its tech progress — it is the birthplace of a number of unicorn startups like Skype and boasts the world’s most advanced e-governance platform, making it the only country where people can even vote over the internet. Citizen & residents have access to over 5’000 e-services starting from e-police, e-health to e-law, e-tax and digital signatures which have virtually replaced physical signatures across the board and are legally recognised by the Estonian state.

As a result, about 4 years ago, the Estonian government together with some private sector contributors like 1Office started planning and launched e-Residency — where after the Estonian Police & Border Guard runs a background check on applicants, they are issued a digital ID card. That card allows these now turned e-residents to access close to 1’500 e-services of the Estonian e-governance platform to establish and manage their Estonia / EU-based company entirely online, access business banking solutions, manage taxes, etc. The initiative has been extremely well-received around the world and there are already about 70’000 e-residents from almost 170 countries, running close to 7’000 companies. Some well-known e-residents includes Bill Gates, Richard Branson, Jack Ma & Shinzo Abe.

This growth is phenomenal and can be attributed to the efficient and cost-effective advantages of e-Residency — unlike most other EU-member states Estonia does not mandate companies to have a local director / country manager, etc. and the e-resident owns & controls their company fully on their own, there are also no complicated laws like having a board meeting in the country once a year, etc. as many other countries have. And for a lot of location-independent entrepreneurs the biggest advantage is that Estonia does not have any tax on reinvested profits or undistributed income, which in essence means there is no corporate tax.

Of course, tax liability planning is something every e-resident generally invests input for most remote entrepreneurs the tax scheme is extremely helpful since you generate value around the world and only pay taxes on whatever is paid out in the form of salaries or dividends. But it’s always good to ask tax advise from service providers as taxes are usually paid in the location where your company has permanent establishment, which means that usually you’ll pay taxes where you make your profit. It’s also important to understand that taxes are always case sensitive and therefore you should definitely start your business planning with a tax consultation that different service providers offer. 1Office offers Initial Tax Consultation which is the best investment to your future — there won’t be any bad surprises after and you can make some really smart choices if you know the background of the tax system.

To offer best experince for remote entrepreneurs, 1Office has launched a package that includes all aspects that entrepreneurs need to start their business activities remotely. This means that all the legal topics are taken care of and you only need to focus on your business!

So, if you need help to start & continue this journey, please feel free to learn more here or contact sales@1office.co.

[/vc_column_text][/vc_column][/vc_row]