Accounting and business services by local experts in Estonia

Accounting and business services in Estonia by local experts

Business licence no: FIU000139

Official Marketplace Member

20K+ clients served

1500+ companies formed

OUR SERVICES

Company Formations

Accounting Services

Legal services

Business Address

Request our pricelist

or get a quick quote

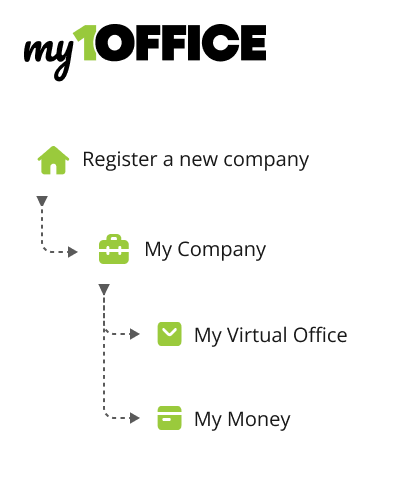

Manage your business easily anywhere, anytime. The new My1Office web app comes packed with features that make running your company smoother than ever.

- Business calendar with deadlines you can sync to your personal phone calendar

- Create and send invoices in seconds

- Clear and visual dashboard of your company’s finances

- Add the web app to your phone for mobile access anytime

- Everything in one place, no downloads needed

WHY PEOPLE CHOOSE US

OUR EXPERTISE

Local and foreign companies operating in Estonia

Building your business in Estonia? Let us handle the financial foundations. Our team of dedicated accountants understands Estonia’s unique business environment and tax framework, making compliance straightforward for both local entrepreneurs and international companies expanding here.

We provide personalized accounting solutions that grow with you—whether you’re a sole proprietor taking your first steps, an established SME, or an e-commerce venture navigating Estonia’s digital-friendly landscape. From day-to-day bookkeeping to comprehensive financial reporting, we speak your business language.

Local and foreign companies operating in Estonia

Building your business in Estonia? Let us handle the financial foundations. Our team of dedicated accountants understands Estonia’s unique business environment and tax framework, making compliance straightforward for both local entrepreneurs and international companies expanding here.

We provide personalized accounting solutions that grow with you—whether you’re a sole proprietor taking your first steps, an established SME, or an e-commerce venture navigating Estonia’s digital-friendly landscape. From day-to-day bookkeeping to comprehensive financial reporting, we speak your business language.

Wholesale & retail

Wholesale and retail companies necessitate custom solutions in accounting due to the nature of their business, where profit margins are often tight. These industries typically operate on high volumes and low margins, making it essential to closely monitor and control costs, optimize pricing strategies, and effectively manage inventory. A tailored accounting approach can provide the necessary tools and techniques to address the specific challenges faced by wholesale and retail companies.

Biotech & healthcare

The biotech and healthcare industry requires custom solutions in accounting due to the unique intricacies and regulatory requirements inherent in these sectors. Companies operating in biotech and healthcare face complex financial challenges, including research and development costs, clinical trials, intellectual property management, and regulatory compliance.

Logistics

The logistics sector demands custom solutions in accounting due to its intricate and multifaceted nature. Logistics companies face unique financial challenges, such as managing complex supply chains, optimizing transportation costs, and monitoring inventory levels. The sector’s success heavily relies on effective cost control, efficient resource allocation, and accurate tracking of key performance indicators.

Wholesale & retail

Wholesale and retail companies necessitate custom solutions in accounting due to the nature of their business, where profit margins are often tight. These industries typically operate on high volumes and low margins, making it essential to closely monitor and control costs, optimize pricing strategies, and effectively manage inventory. A tailored accounting approach can provide the necessary tools and techniques to address the specific challenges faced by wholesale and retail companies.

Biotech & healthcare

The biotech and healthcare industry requires custom solutions in accounting due to the unique intricacies and regulatory requirements inherent in these sectors. Companies operating in biotech and healthcare face complex financial challenges, including research and development costs, clinical trials, intellectual property management, and regulatory compliance.

Logistics

The logistics sector demands custom solutions in accounting due to its intricate and multifaceted nature. Logistics companies face unique financial challenges, such as managing complex supply chains, optimizing transportation costs, and monitoring inventory levels. The sector’s success heavily relies on effective cost control, efficient resource allocation, and accurate tracking of key performance indicators.

Startups & freelancers

Accounting for startups requires a flexible approach that accommodates rapid changes, uncertain revenue streams, and evolving business models. Custom accounting solutions for startups encompass specialized tools and methodologies to address these dynamics effectively. This includes implementing scalable accounting systems that can accommodate growth, providing real-time financial insights for informed decision-making, and establishing robust budgeting and forecasting processes to manage cash burn and runway.

Information technology

An IT company, with its dynamic and rapidly evolving nature, requires a strong accounting partner to navigate the intricate financial landscape and achieve long-term success. 1Office as an accounting partner brings invaluable expertise in managing financial records, tax compliance, and financial planning.

Construction

Construction companies require special attention when it comes to accounting due to the unique complexities inherent in their operations, particularly in subcontracting and managing payrolls. A robust accounting system tailored to the construction industry can efficiently handle subcontractor management, track costs, and accurately allocate expenses to different projects.

Startups & freelancers

Accounting for startups requires a flexible approach that accommodates rapid changes, uncertain revenue streams, and evolving business models. Custom accounting solutions for startups encompass specialized tools and methodologies to address these dynamics effectively. This includes implementing scalable accounting systems that can accommodate growth, providing real-time financial insights for informed decision-making, and establishing robust budgeting and forecasting processes to manage cash burn and runway.

Information technology

An IT company, with its dynamic and rapidly evolving nature, requires a strong accounting partner to navigate the intricate financial landscape and achieve long-term success. 1Office as an accounting partner brings invaluable expertise in managing financial records, tax compliance, and financial planning.

Construction

Construction companies require special attention when it comes to accounting due to the unique complexities inherent in their operations, particularly in subcontracting and managing payrolls. A robust accounting system tailored to the construction industry can efficiently handle subcontractor management, track costs, and accurately allocate expenses to different projects.

Why is Estonia an attractive location for business formation?

Estonia is known for its digital-first business environment, transparent regulations, and simple company administration.

Key advantages include:

EU member state with access to the single market

0% corporate income tax on retained and reinvested profits

Fully digital company management

Predictable legal and tax framework

This makes Estonia especially attractive for international founders and online businesses.

What are the main types of business entities in Estonia?

The most common business entities in Estonia include:

- Private Limited Company (OÜ)

- Public Limited Company (AS)

- Self-employed Person (FIE)

- Branch of a Foreign Company

- Limited Partnership (UÜ)

- General Partnership (TÜ)

For international entrepreneurs, the Private Limited Company (OÜ) is typically the most suitable and popular option due to its flexibility and relatively low capital requirements.

What types of business entities exist in Estonia?

Several legal forms are available in Estonia, but the Private Limited Company (OÜ) is the most commonly used. It offers limited liability, flexible ownership, and is well suited for foreign founders, startups, and international businesses. Other options include public limited companies, branches, and sole proprietorships.

Can a foreigner start a company in Estonia?

Yes. Foreigners can fully own and manage an Estonian company.

You do not need Estonian citizenship or residency. Many founders use Estonian e-Residency to manage their company remotely.

Do I need Estonian e-Residency to start a company?

No. Estonian e-Residency is not mandatory, but it simplifies digital signing, online company management, and communication with authorities. Without e-Residency, certain steps may require local representation.

How much does it cost to register a company in Estonia?

The cost depends on whether the company is registered online or through a notary, whether e-Residency is used, and whether additional services such as a business address or accounting are required. A precise cost estimate is usually provided based on the chosen setup.

How long does it take to register a company in Estonia?

Company registration in Estonia usually takes:

1–5 working days with proper documentation

Delays may occur if additional checks or documents are required.

How much do accounting services cost in Estonia?

Accounting service costs in Estonia vary based on the complexity of the business, the number of transactions, and whether payroll or tax filing is included. Each client receives a tailored quote based on their individual requirements.

What are the accounting requirements for Estonian companies?

Estonian companies must:

- Submit annual reports within 6 months after the end of the financial year

- File monthly VAT returns by the 20th of the following month (if VAT registered)

- Submit employee tax and social security contributions by the 10th of the following month

Estonian accounting must comply with Estonian GAAP or IFRS standards, and proper bookkeeping records must be maintained in Estonian or English.

How often does accounting need to be done in Estonia?

Typically:

Ongoing bookkeeping during the year

Annual report submission once per year

Monthly VAT and payroll reporting if applicable

Requirements depend on company activity and registrations.

How are Estonian companies taxed?

Key tax features include:

0% corporate tax on retained profits

Corporate tax is paid only when profits are distributed

VAT applies if registered

Payroll taxes apply if salaries are paid

Tax obligations depend on company activity and structure.

When is VAT registration required in Estonia?

VAT registration is required when a company exceeds the Estonian VAT turnover threshold or carries out certain EU or cross-border transactions. Voluntary VAT registration may also be possible in specific cases.

Can I manage an Estonian company remotely?

Yes. Estonia is designed for remote business management. With the right setup, companies can handle accounting, filings, and corporate administration online without being physically present in Estonia.

However, some specific activities may require a local contact person or address, particularly for regulatory compliance or receiving official correspondence. Virtual office services can fulfill this requirement in many cases.

Do I need a business address in Estonia?

Yes. Every Estonian company must have a registered address in Estonia. Many non-resident founders use a virtual office or business address service to meet this requirement.

Can I open a bank account for an Estonian company remotely?

In many cases, yes. Fintech and electronic money institutions often allow remote onboarding, while traditional banks may require a stronger connection to Estonia. Available options depend on the company’s structure and activity.

What are the main banking considerations for Estonian companies?

Estonian companies typically need:

- A local business bank account (though fintech alternatives are increasingly available)

- Compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations

- Regular transaction monitoring and reporting

Traditional Estonian banks have become more selective with non-resident company accounts, often requiring demonstrable ties to Estonia or substantive business operations. Fintech platforms and e-money institutions have emerged as alternatives, though they may offer more limited services than traditional banks.

What ongoing compliance obligations do Estonian companies have?

Estonian companies must maintain:

- Regular accounting and tax filings

- Beneficial ownership registration and updates when changes occur

- Board member and shareholder information in the Business Register

- VAT registration if the turnover exceeds €40,000 in a calendar year

- Compliance with sector-specific regulations if applicable

Companies must also hold at least one annual general meeting (which can be conducted remotely) and keep formal minutes of major company decisions, even for single-member companies.

Why use 1Office when starting a business in Estonia?

1Office combines local Estonian expertise with international experience. We support foreign founders with company formation, accounting, tax compliance, and business address services, ensuring that your Estonian company remains compliant and easy to manage as it grows.

Do Estonian companies need to submit annual reports even if there is no activity?

Yes. Every Estonian company must submit an annual report to the Business Register, even if the company had no transactions, no employees, and no revenue during the financial year. Dormant companies still have reporting obligations.

Do non-resident directors need to visit Estonia to manage the company?

No. Estonian companies can be fully managed remotely. Directors and shareholders do not need to visit Estonia to run the business, provided the company has proper digital access and local compliance support where required.

Can an Estonian company operate internationally and invoice EU or non-EU clients?

Yes. Estonian companies can freely operate across the EU and internationally. VAT registration and invoicing rules depend on turnover, client location, and the nature of services or goods provided.

How is profit taxed in Estonia if it is not distributed?

Profits that are retained and reinvested in the company are not subject to corporate income tax. Corporate tax applies only when profits are distributed as dividends, making Estonia attractive for growth-focused businesses.

Do Estonian companies need an accountant based in Estonia?

While the accountant does not need to be physically based in Estonia, accounting must comply with Estonian regulations and reporting standards. Most foreign founders use local accounting providers to ensure compliance and avoid penalties.

Who typically uses 1Office for Estonia?

1Office works primarily with international founders, e-residents, startups, holding companies, and SMEs that need a reliable partner for company formation, accounting, tax compliance, and ongoing administration in Estonia.

What makes Estonia an attractive location for business formation?

Estonia offers a highly digital business environment with e-Residency options, allowing non-residents to establish and manage companies remotely. The country features a straightforward tax system with 0% corporate income tax on reinvested profits, minimal bureaucracy, and a strong digital infrastructure. As an EU member state, Estonia also provides access to the European market while maintaining competitive operational costs compared to Western European countries.

What are the main types of business entities in Estonia?

The most common business entities in Estonia include:

- Private Limited Company (OÜ)

- Public Limited Company (AS)

- Self-employed Person (FIE)

- Branch of a Foreign Company

- Limited Partnership (UÜ)

- General Partnership (TÜ)

For international entrepreneurs, the Private Limited Company (OÜ) is typically the most suitable and popular option due to its flexibility and relatively low capital requirements.

How long does it take to register a company in Estonia?

Company registration typically takes between one and five working days once all documentation is in order. Delays may occur if additional verification or information is required.

When is VAT registration required in Estonia?

VAT registration is required when a company exceeds the Estonian VAT turnover threshold or carries out certain EU or cross-border transactions. Voluntary VAT registration may also be possible in specific cases.

What are the accounting and tax reporting requirements for Estonian companies?

Estonian companies must:

- Submit annual reports within 6 months after the end of the financial year

- File monthly VAT returns by the 20th of the following month (if VAT registered)

- Submit employee tax and social security contributions by the 10th of the following month

Estonian accounting must comply with Estonian GAAP or IFRS standards, and proper bookkeeping records must be maintained in Estonian or English.

Can I manage an Estonian company remotely?

Yes. Estonia is designed for remote business management. With the right setup, companies can handle accounting, filings, and corporate administration online without being physically present in Estonia.

What are the main banking considerations for Estonian companies?

Estonian companies typically need:

- A local business bank account (though fintech alternatives are increasingly available)

- Compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations

- Regular transaction monitoring and reporting

Traditional Estonian banks have become more selective with non-resident company accounts, often requiring demonstrable ties to Estonia or substantive business operations. Fintech platforms and e-money institutions have emerged as alternatives, though they may offer more limited services than traditional banks.

Do I need a business address in Estonia?

Yes. Every Estonian company must have a registered address in Estonia. Many non-resident founders use a virtual office or business address service to meet this requirement.

What ongoing compliance requirements should I be aware of?

Estonian companies must maintain:

- Regular accounting and tax filings

- Beneficial ownership registration and updates when changes occur

- Board member and shareholder information in the Business Register

- VAT registration if the turnover exceeds €40,000 in a calendar year

- Compliance with sector-specific regulations if applicable

Companies must also hold at least one annual general meeting (which can be conducted remotely) and keep formal minutes of major company decisions, even for single-member companies.

REQUEST A FREE CONSULTATION

OUR PARTNERS

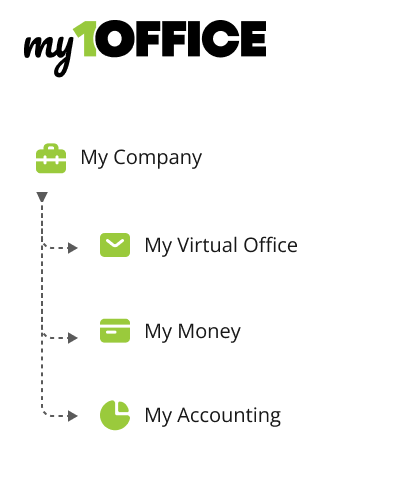

Simplify your business with My1Office

With my1Office, you have the convenience of handling all the necessary steps for company registration and management in one place. From incorporating your company to fulfilling ongoing administrative tasks, the portal provides a streamlined and user-friendly interface.

By utilizing my1Office as your comprehensive business management tool, you can save time and effort by accessing all the essential functions and information in one centralized platform.

Low management expense

In addition to the minimal share capital requirement of just €1, managing an Estonian company located within the EU also offers the advantage of lower costs. Company formation is a one-time expense, and if you require services such as a contact person, address, or accounting, we provide them at reasonable prices.

Get in touch

Email us

Call us

Visit us

Mon-Fri 9.00-17.00, local time