This is a guest post by Neat.

The banking sector has not always been supportive to SMEs. Financial tools that are readily available to corporates are rarely as accessible for young or small businesses – and sometimes that can present a roadblock to entrepreneurs that want to expand their businesses worldwide. Let’s take a look at some of the finance obstacles that appear when you want to expand the borders of your business – and what new technologies can help you get past them.

Cross-border payments are expensive

Perhaps you’ve found some excellent suppliers in China. The prices are favourable, production times are efficient, and your peers have recommended this company. However, you’re only just starting out and you realise that sending money to China every month can really add up. If you’re trying to get a global business off the ground as an SME – say if you have overseas suppliers or customers paying in multiple currencies – cross-border payments can be a huge sticking point, as they can really eat away at your capital.

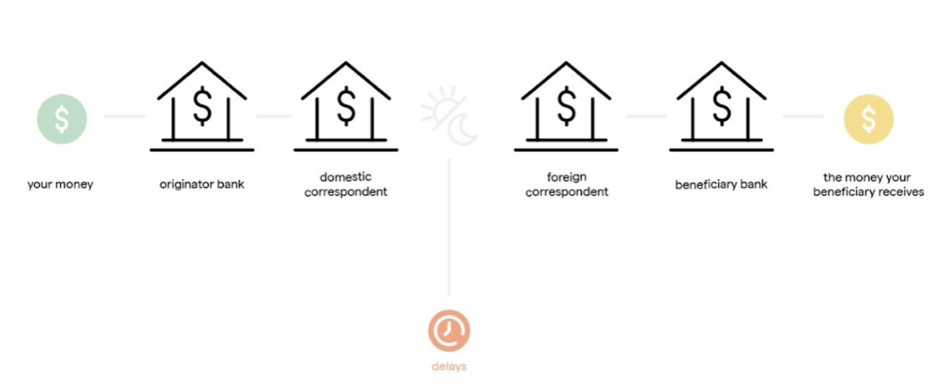

When you send an international bank wire, it’s usually sent via SWIFT, which is a system of correspondent banks around the world that work together to transfer funds. For example, if you were to send a transfer through HSBC in Hong Kong to JP Morgan in the United States, it would travel through the SWIFT network. The thing is that to get from HSBC to JP Morgan, your funds pass through intermediary banks who help process the transfer.

There can be added fees at every stage of this transfer – meaning one of the biggest pain points of SWIFT is that the fees are pretty unpredictable, and the amount your beneficiary receives could differ from what you (and they) had expected. Some SMEs who choose to avoid the SWIFT network might opt for sending money via third-party services like PayPal or Western Union. Their popularity is mostly due to the fact that business owners are already familiar with the tool, as well as its buyer protection for PayPal in case goods don’t get delivered. However, this comes at a high cost of FX fees which can range from 3-5%.

For businesses that continue to have a laser sharp focus on their cash flow, the extra charges that come with international payments can hit hard. Not to mention, they are often unpredictable and therefore hard to include when forecasting. Typically what we see is that customers may use it when they’re just starting out, but once they’re comfortable with their suppliers and are starting to place larger orders, they’ll look for more cost-effective options. Many FinTech companies (like those in the neobanking or cross-border payments space) now offer more convenient and cheaper options for customers to pay their suppliers globally.

Foreign currency accounts can be difficult to maintain

If you’re regularly transacting in different currencies, it makes a lot of sense to get a bank account in a foreign currency, so you don’t have to keep converting funds back and forth. For example, if you’re a UK-based business transacting all over Europe in euros you can end up saving a lot by opening a euro account. Most high-street banks in the UK offer euro currency accounts to existing customers. If you open a currency in its local jurisdiction (for example, GBP account in the UK), you can even eliminate the need for international payments.

One challenge here is that it’s not easy to maintain multiple accounts. Perhaps you have 3 separate bank accounts for pounds sterling, US dollars, and euros. That’s three times the amount of monthly minimum balances, monthly fees, and application fees you have to pay attention to. Zoning in on monthly minimum balances in particular, it can add up to a lot of capital that’s just sitting in your accounts that you’re not using to grow your business.

What’s more, keeping track of multiple currencies from multiple accounts adds another layer of complexity to your accounting as well. Whereas some traditional banks do have a global presence, being a business customer of say HSBC in the UK doesn’t mean you can automatically open an account for your company in Hong Kong, and even if you do manage to open the account, these accounts are completely separate with different logins.

What neobanks bring in is the ability to open multi-currency accounts, across multiple jurisdictions that can be opened with one application and managed from within one platform.

It’s challenging for non-residents to open a business bank account

If you’re not based in the country you want to do business in, it goes without saying that it’ll be more of an undertaking than opening one in your local jurisdiction. In the U.K. for example, most banks do tend to ignore applications from non-residents. So if you’re based in Germany but want to expand into the UK, you may find it difficult to open a business bank account for your company. This is the case with most places in Europe.

If you’re looking for a currency account outside of Europe, however, it can be even more complicated for an SME, especially when it comes to Asia. If you’re like many businesses who work with Chinese suppliers, you may want to open a bank account in Hong Kong in order to smooth your payments. Many suppliers in Mainland China have bank accounts in Hong Kong, as capital controls are non-existent and it’s easier to work with international clients from there.

However, opening a Hong Kong business bank account can be one of the most frustrating experiences for early entrepreneurs: the process can take months, multiple trips to Hong Kong, and oftentimes end in rejection. In short, it’s not easy for SMEs. If you want a business account in another jurisdiction or currency, you may have an easier time with international banks such as HSBC and Barclays, who are more poised to open bank accounts for foreign-registered companies. Alternatively, more and more, there are many non-bank FinTech solutions that can open accounts for foreign companies and non-residents (as their applications are online) too.

Banking is changing and FinTech is the future

In a banking landscape that hasn’t typically been friendly to small businesses, FinTech companies are growing in popularity and variety – and SMEs are increasingly finding their solutions in these alternative services. According to EY, 55% of SMEs that serve a global customer base use FinTech solutions, and 56% of SMEs globally have used FinTech for banking or payments services in the past 6 months.

Now in the U.K. and Europe, there are numerous FinTech companies offering digital alternatives to what was traditionally a banking service – such as loans, current accounts, and more. Their offerings are often more accessible and more affordable than what banks and traditional institutions can offer. OakNorth, for example, is a new U.K. bank (and startup unicorn) that provides business loans for small and medium sized businesses – something that was difficult for SMEs to secure when looking to banks. Other well-known FinTechs include N26, Tandem Bank, and new to Europe, there’s Neat as well.

At Neat, we help entrepreneurs expand their businesses worldwide, by providing fully digital multi-currency accounts that can be opened and managed online. Our mission is to take away the obstacles SMEs face when trying to expand to Asia, by making cross-border payments smooth, accessible, and fair. Neat provides you with a business account that can hold funds in both Europe and Asia. Neat Business gives you GBP and EUR accounts in the UK as well as USD and HKD accounts in Hong Kong – meaning you can easily accept payments from both your European and Asian customers, and pay Chinese suppliers in Hong Kong – without worrying about international transfers or multiple account maintenance fees. Have a look what type of companies can sign up for Neat Business.

Globally, 25% of SMEs use some sort of FinTech solution to run their businesses, and that adoption rate is rising. FinTechs are redefining what financial services can look like, and that opens up a world of choice for businesses around the world.

Neat is now available for both Estonian and UK companies in 1Office Portal – just fill the application and choose Neat under the

additional services. With 1Office Portal the company registration process is made simple – after filling the application, the company will

be ready by the next working day.