Closing your Swedish company or a branch doesn’t have to be a hassle

Local expertise

Hassle-free

Quick and efficient

Clear pricing

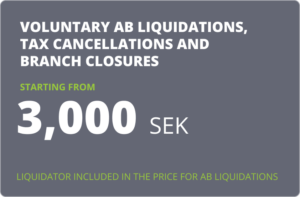

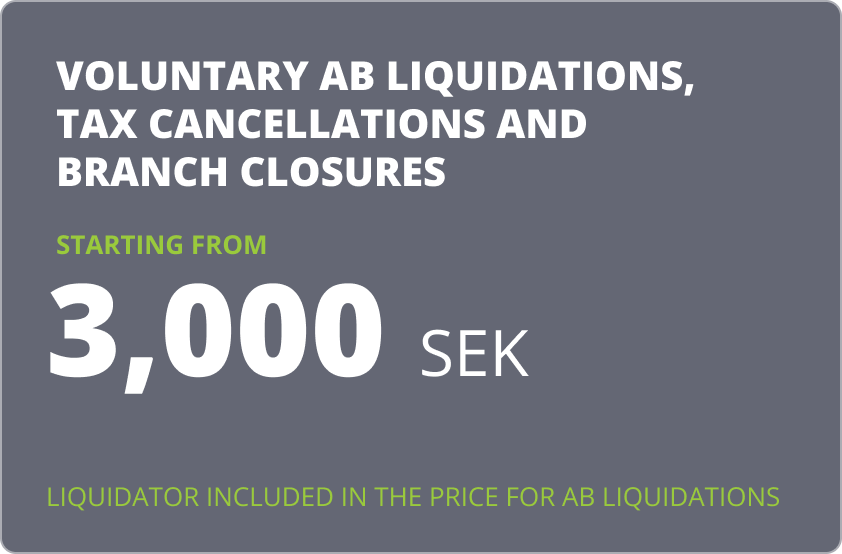

Voluntary Swedish AB Liquidation

STARTING FROM

Tax Deregistrations

STARTING FROM

Branch closures

STARTING FROM

Closure processes: Step-by-step

- Your decision

You choose to close down and reach out to us. After sending us relevant documentation about your company, we will send you a personalised price offer. - Forward guidance

We will provide advice and guidance on the sale of assets and the removal of liabilities if the procedure requires it. - Preparation of documents

We will prepare the necessary documents for tax de-registrations, liquidations or closure of branches.

- Registration

The liquidator notifies the Swedish Commercial Register (Bolagsverket) or the Swedish Tax Agency (Skatteverket). - Finalisation and deregistrations

Submitting of mandatory reports for relevant Swedish authorities of liquidations, closures or deregistrations.

Important! Your company’s accounting must be current before we begin. View our accounting services to get your reports and accounting in order.

Frequently Asked Questions

How long does it take to liquidate a Swedish company or tax deregistrations?

Liquidation usually takes 7-10 months, depending on the company’s financial situation, and cancellation of tax registrations usually take 1 month.

What’s my role in the process?

At the start of the process, we’ll take over all of the accounting and then take care of the rest. For you, the process is passive and worry-free.

Who manages the tax deregistrations for branches of foreign companies operating in Sweden?

Our team will manage and handle all the tax deregistrations of your branch.

Can I avoid liquidation?

Yes! Options like putting your company “on a shelf,” or canceling tax registration are available. Ask us how.

Trusted by business owners across 7 different countries

Get in touch

Email us

Call us

Visit us

Mon-Fri 8.00-16.00, local time