As the year closes, Swedish limited companies (aktiebolag, AB) must tie up financial and administrative tasks to stay compliant. Missing deadlines can trigger late-filing penalties, loss of F-tax status, or even liquidation in serious cases. This 2025 guide walks you through the essentials: audit requirements, negative equity checks, preliminary tax (F-tax), corporate income tax (INK2), VAT, payroll, and industry-specific filings.

1) What counts as a year-end obligation in 2025?

Year-end obligations for Swedish ABs in 2025

Swedish requirements flow from the Companies Act (ABL) and Annual Accounts Act, with tax administration by Skatteverket. Typical year-end tasks include auditor review (if mandated), negative equity checks, preliminary tax adjustments, INK2 filing, VAT reconciliation, payroll reporting, and any permit/licence renewals.

Need a local team to carry the load? 1Office Sweden can coordinate your full year-end: accounting, tax updates, filings, and deadlines.

2) Do you need an auditor? (Revisionsplikt)

An AB can opt out of an auditor only if, in each of the two most recent financial years, it does not exceed more than one of these thresholds:

-

> 3 employees (average)

-

> SEK 1.5 million in balance-sheet total

-

> SEK 3 million in net sales

If your company exceeds more than one threshold for two straight years, you must appoint a qualified auditor. Appointment applies from the third financial year.

Growing fast this year? Re-check the thresholds now and appoint an auditor before finalising your financial statements to avoid defects in your annual report.

3) How to avoid negative equity and forced liquidation in Sweden

If there is reason to believe equity is below 50% of registered share capital, the board must immediately prepare a kontrollbalansräkning (special balance sheet) and take statutory steps; failing to act can expose directors to personal liability and may lead to compulsory liquidation. Sources: Bolagsverket.

Practical steps if equity is thin:

-

Turnaround plan and close monitoring

-

Capital injection or shareholder contribution

-

Cost measures / restructuring

-

Accountant review to validate position before year-end

4) How to renew preliminary tax (F-tax) at year-end

Preliminary corporate tax (F-tax): review and renew your estimate

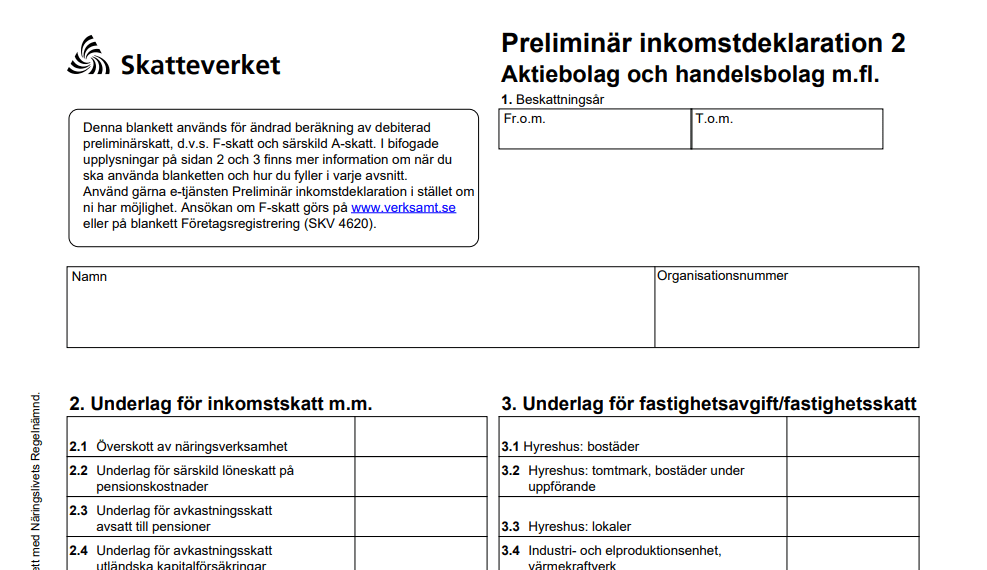

Companies pay debiterad preliminärskatt (preliminary corporate income tax) through the year. As year-end approaches, update your estimate if profits diverged from the original plan by submitting a Preliminär inkomstdeklaration (for legal entities: SKV 4313) . It’s normally F-tax for companies; A-skatt is primarily for employees (companies can have A-skatt in exceptional cases, but the normal status is F-skatt).

Tip: Adjust early to avoid interest on residual tax or unnecessary overpayments. If you need expert help, contact us.

5) INK2 deadlines: how to find your exact 2025 date

Corporate income tax return (Inkomstdeklaration 2 / INK2)

All ABs file INK2 after the financial year ends. The deadline depends on the company’s financial year-end; Skatteverket sets four declaration windows across the year. For calendar-year companies (ending 31 Dec 2024), the 2025 due date falls in early August. Always check your exact deadline in Skatteverket’s “Important dates” or your Mina sidor inbox.

What to prepare:

-

Financial statements alignment (INK2 main form + INK2R accounts schema + INK2S tax adjustments)

-

Reconciliations for tax credits, interest limitations, group contributions, etc.

-

Use local experts help to prepare and submit. Contact 1Office Sweden.

Missed the window? Skatteverket may charge a late submission penalty (SEK 6,250) and, if problems persist, can reassess and even revoke F-tax approval.

6) Year-end VAT reconciliation in Sweden: checklist

VAT (moms) in Sweden: period, reconciliation, and fixes

Your VAT period is monthly, quarterly, or annual, depending on your turnover (and registration choice). VAT must be paid the same day the return is due. Use year-end to reconcile output vs input VAT, fix discrepancies, and confirm you’ve filed all periods.

On annual VAT, double-check before final statements and correct in the final period rather than letting issues roll into 2026.

7) Payroll in Sweden: AGI & contributions

Payroll: employer declarations & contributions in Sweden

If you have employees, ensure monthly employer declarations (arbetsgivardeklaration på individnivå, AGI) are submitted on time and match payroll records; payroll taxes and employer contributions must also be correct (full employer contribution currently 31.42%, age-related exceptions apply).

Verify year-end items (bonuses, benefits, pension premiums) and correct any AGI errors. Our Swedish experts are ready to help with any problems.

8) Sector-specific registrations & renewals in Sweden

Some industries require permits, licences, environmental filings, vehicle/equipment registrations or other annual updates tied to the fiscal year. Review all non-tax obligations to prevent operational disruptions in Q1.

9) Keep an eye on rule changes into 2026

Accounting frameworks (K2/K3 updates) and EU-level digital reporting initiatives continue to evolve. Start planning early so that any system or process changes happen well before deadlines.

Quick, scannable checklist for businesses in Sweden (print this)

-

Audit thresholds re-checked; auditor appointed if required.

-

Equity test performed; if < 50% of share capital then kontrollbalansräkning + board actions.

-

Preliminary tax (F-tax) estimate reviewed; Preliminär inkomstdeklaration filed if needed

-

INK2 deadline confirmed for your year-end; forms INK2/INK2R/INK2S prepared and sent

-

VAT periods reconciled; all returns and payments submitted.

-

AGI and employer contributions checked; corrections filed where needed.

-

Permits/licences and industry registrations reviewed and renewed.

How 1Office Sweden makes year-end easy

For foreign-owned and growing Swedish companies, we:

-

Close books and prepare INK2, INK2R, INK2S

-

Review equity and advise on capital measures

-

Update preliminary tax (F-tax) with Skatteverket

-

Reconcile and file VAT and AGI

-

Handle industry-specific filings and renewals

Get year-end help now and talk to 1Office Sweden today!

Need tax filings? Book an INK2 & VAT help.